The most important indicator characterizing the economic power of the country is national wealth. National wealth is a set of material goods accumulated in society as a result of the previous labor of people, and natural resources suitable for use.

The composition of national wealth should include the totality of the country’s resources (economic assets), which are a prerequisite for the implementation of the process of production of goods, the provision of services and the provision of human life. The main feature of its constituent objects is the possibility of obtaining economic benefits by their owners. The term “economic asset” is used to refer to elements on which individual or collective property rights can be established and the possession or use of which brings certain economic benefits to their owner.

In statistics, the national wealth of the country is calculated at the beginning and end of the year. Indicators of national wealth are indicators of reserves, which during the year can not only increase, but also decrease. Inventory figures should be distinguished from flow figures (output or income) that are calculated over a period by summing up the corresponding figures for the individual time intervals of that period.

There are differences in the calculation of national wealth according to the methodology of the balance of the national economy (BNH) and the SNA. Thus, according to the BNH methodology, national wealth is understood as a set of labor products (national property) that have been accumulated by generations, and natural resources involved in economic turnover.

In the market form of management (according to the SNA methodology), the national wealth includes not only the totality of material goods created by human labor and natural resources used, but also net financial assets.

All assets included in the national wealth, in accordance with the recommendations of the UN Statistical Commission, are divided into two main groups:

non-financial; financial (Fig. 13).

Non-financial assets are objects owned by institutional units and bring them real or potential economic benefits for a certain period as a result of their use or storage. Depending on the method of creation, such assets are divided into reproducible (produced) and non-reproducible (unproduced).

Reproducible non-financial assets are created as a result of production processes and include three main elements:

fixed assets (fixed assets); inventories of working capital; Values.

Fixed assets are reproducible assets that are repeatedly or permanently used to produce goods and provide market and non-market services and operate for a long time.

Tangible fixed capital consists of buildings (including dwellings), structures, machinery and equipment (with the exception of military equipment), and cultivated (cultivated) assets. This group does not include machinery and equipment purchased by households for final consumption (cars, refrigerators, televisions). They are taken into account in the reference article “Consumer Durables”. However, if such machines are used by households to carry out the production process, they should be classified as fixed assets.

Cultivated (cultivated) assets are one of the main elements of the material fixed capital in agriculture, which includes the cost of pedigree, productive and working livestock, as well as fruit trees, shrubs and other perennial plantations for the sake of obtaining products from year to year.

Intangible fixed assets include:

geological exploration; computer software (purchased and developed); original works of entertainment genre, literature, art.

The second element that makes up reproducible non-financial assets is inventories of tangible working capital, i.e. goods created in the current or earlier period and intended for sale or use in a later period. These include the consumer’s production stocks; stocks of finished products in warehouses of manufacturers and at enterprises of the sphere of circulation; goods in transit; state reserves; work-in-progress in all sectors of the national economy.

Production stocks include raw materials, materials, fuel, tools, seeds, feed and other goods that their owners purchase and store for use as elements of intermediate consumption in their enterprise, i.e. goods not intended for resale. A characteristic feature of production stocks is that they are consumed during one production cycle and their value is fully included in the value of goods and services produced from them or with their participation.

Work-in-progress is goods and services whose production has begun, but has not yet been fully finished and will continue in the subsequent period.

Finished products are goods that are completely manufactured and intended for sale or shipment to other business entities.

Goods having the same natural-material form may belong to different elements of national wealth, depending on their actual use at the time at which the amount of equity of the economic sector or the country as a whole is determined. The machine used in the enterprise is part of the fixed assets. The same machine, located in the warehouse of the finished products of the manufacturer, belongs to the category of inventories of material working capital.

Values are included in the composition of reproducible tangible assets. These are expensive durable items that are purchased and stored as inventories of value, and are generally not used in the manufacturing process or for consumption. By acquiring this element of national wealth, their owners expect that the real value of such goods will increase or at least not change. These include: precious metals and stones, antique and jewelry, unique works of art, collections.

Durable consumer goods, i.e. household goods accumulated by the population, are traditionally counted as one of the three main elements of national wealth. It is impossible to determine its value according to statistical reporting and accounting data. This indicator is calculated using the “continuous inventory” method. This definition and the method itself belongs to the American economist R. Goldsmith, who first used it in 1951, it is used to determine the cost of fixed capital in replacement prices in a number of countries (USA, Germany, Canada, England). On the basis of materials of budget surveys and data on the volume of retail trade turnover, the amount of expenditures of the population on the purchase of certain types of durable goods (clothes, footwear, furniture, cars) is determined. For each commodity group, the average service life of such property is established. The value of consumer durables at the end of the period is determined by adding to the value of the property accumulated at the beginning of the year the value of the newly purchased goods and subtracting the total amount of annual depreciation.

According to the methodology of the 1993 SNA, fixed assets and household goods should be valued at replacement cost less depreciation and working capital at full replacement cost.

Non-financial non-reproducible assets are not the result of the production process. They, in turn, are divided into two groups: tangible and immaterial.

Tangible non-reproducible assets are land, subsoil wealth, non-growing biological and water resources. A characteristic feature of the natural resources included in this group is that the right of ownership of them can be established and transferred from one subject to another. If such a right cannot be established, the relevant element is not included in the national wealth. The valuation of this element of wealth should take into account the costs associated with the transfer of ownership of these assets and the costs of improving them.

In domestic statistics, natural resources included in economic circulation are included in the national wealth, but due to the lack of valuation, their accounting is carried out only in physical terms.

The mineral wealth is the explored reserves of minerals suitable for exploitation in modern conditions, i.e. the exploitation of which is technically possible and economically expedient.

Non-growing biological resources include productive plants and animals whose natural growth and renewal are not directly controlled by institutional units, but which can be used for economic purposes (forests, fish that live in natural water bodies and are not specifically bred). Non-growing biological resources belong to the national wealth only to the extent to which ownership rights have been established.

According to the methodology recommended by the UN Statistical Commission, surface waters should be accounted for in the composition of land resources, and only groundwater resources belong to water resources.

Intangible non-reproducible assets are created outside the production process and their ownership is established through appropriate legal actions. These include documents authorizing their owner to engage in certain activities or produce goods and services. These are patents, copyright, lease agreements.

Financial assets arise when one institutional unit (creditor) provides funds and receives payment from another unit (debtor) in accordance with the terms of the contract. The exceptions are monetary gold and special drawing rights.

Monetary gold is gold owned by a country’s governing monetary institutions and held as a financial asset. All other gold held by other businesses and individuals is treated as a commodity, inventories of tangible working capital or valuables.

Special drawing rights are created by the IMF as an international financial asset and are distributed among its members in order to replenish the reserves of a given country.

Cash as a financial asset includes all banknotes and coins in circulation, regardless of whether they are monetary units of a given country or other states. Coins that are not in circulation (anniversary, in the collection) are excluded from the asset.

Financial assets also include deposits, securities (bonds, bills of exchange, debt), loans, shares, trade loans, advances, foreign direct investment.

Fixed production assets (OPF) are a part of the means of production that participate in the production process for a long period, retain their original natural form and transfer their value in parts to the products created.

Fixed assets by purpose and scope of application are divided into: production and non-production. Production fixed assets are divided into groups depending on which industry the enterprise belongs to. Production fixed assets are divided into buildings, structures, transfer machines and equipment, vehicles, devices, tools, production and household equipment and other types of fixed assets. This classification makes it possible to obtain the specific and technological structure of fixed assets. Non-production fixed assets are concentrated in the infrastructure of the company (social sphere, consumer services, etc.).

Depending on the specific role in the process of creating a product, OPFs are divided into active and passive parts. The attribution of objects to the active and passive part depends on the specifics of the industry.

The total amount of fixed assets, due to their diversity, can be determined only in monetary terms. There are four options for evaluating fixed assets:

1) the total initial cost of fixed assets is their actual cost at the time of commissioning, which includes the entire amount of costs for the construction or acquisition of fixed assets, as well as transportation and installation costs. At this cost, fixed assets are transferred to the balance sheet of the enterprise, and its value remains unchanged during the period of their operation;

2) the total replacement cost characterizes the costs of creating (acquiring) an object in modern conditions, It is determined in the process of revaluation of fixed assets. In the SNA, fixed assets are valued solely at replacement cost;

3) the initial cost less depreciation (residual value) is defined as the difference between the full initial cost and the cost of wear and tear formed at that time;

4) replacement cost minus depreciation characterizes the actual degree of deterioration of the object in the new conditions of reproduction.

Fixed assets are revalued using the conversion factor of the book value of fixed assets to replacement cost. The conversion rate is set for certain types of fixed assets and are differentiated depending on the year of creation (acquisition) of fixed assets. As a result of the revaluation, the total replacement value of fixed assets and the replacement cost minus depreciation are determined.

The main production assets in the process of functioning wear out, transferring their value to the products produced.

Depreciation is a monetary expression of the depreciation value of fixed assets transferred to products. It is included in the cost of production, since it acts as the cost of fixed assets for the production of products.

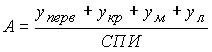

The annual amount of depreciation deductions is determined by the following formula:

,

,

where ![]() is the initial cost;

is the initial cost;

![]() – the cost of major repairs;

– the cost of major repairs;

![]() – the cost of modernization;

– the cost of modernization;

![]() – the cost of liquidation;

– the cost of liquidation;

SPI is the useful life.

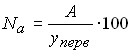

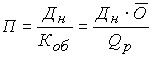

Annual depreciation rates are determined by the formula:

,

,

where A is depreciation deductions.

Depreciation rates are differentiated by individual types and groups of fixed assets. Depending on the mode of operation, natural conditions and the aggressive environment in which fixed assets are operated, correction coefficients are applied for their individual types. Accrual of depreciation on fixed assets in accounting is made monthly. To do this, the depreciation rate is divided by 12. Depreciation on newly commissioned fixed assets is accrued from the first day of the month following the month of their entry into operation, and for retired funds ceases from the first day of the month following the month of disposal.

Depreciation is accrued on fixed assets only during their standard service life. if the object is transferred to conservation or its reconstruction and technical re-equipment is carried out, then during this period depreciation is not accrued and the service life is extended.

For a number of types and groups of fixed assets, depreciation is not accrued (library funds).

Currently, there are several methods of calculating depreciation:

linear; nonlinear; productive.

With the linear method, during the entire standard service life, depreciation is accrued in equal parts of the book value according to the established norms.

With the nonlinear method, depreciation is calculated unevenly over the years. This method includes the sum of years method and the decreasing residue method with an acceleration factor of up to 2.5 times.

The productive method of calculating depreciation is to calculate depreciation based on the depreciable value of the object and the ratio of natural indicators of the volume of products produced in the current period to the established resource of the object.

The balance sheets of fixed assets show their dynamics over the year. They are built at the book value of fixed assets and at their residual value.

The volume of fixed assets at full historical cost at the end of the year (![]() ) is determined according to the following balance sheet scheme:

) is determined according to the following balance sheet scheme:

![]() .

.

Volume of fixed assets at the end of the year at residual value (![]() ):

):

![]() ,

,

where ![]() – liquidated during the year fixed assets at residual value;

– liquidated during the year fixed assets at residual value;

![]() – the initial cost at the beginning of the year;

– the initial cost at the beginning of the year;

![]() – residual value at the beginning of the year;

– residual value at the beginning of the year;

AR – the annual amount of depreciation for full recovery;

B – liquidated fixed assets at historical cost during the year;

P – received fixed assets at full initial cost.

Balance sheets of fixed assets allow you to determine the indicators of movement:

OPF receipt factor:

,

,

Attrition rate of OPF:

,

,

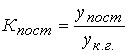

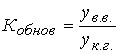

OPF update factor:

,

,

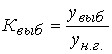

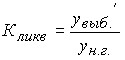

OPF liquidation rate:

,

,

where ![]() – newly introduced fixed assets;

– newly introduced fixed assets;

![]() – retired fixed assets;

– retired fixed assets;

![]() – dropped out due to dilapidation and wear;

– dropped out due to dilapidation and wear;

![]() – received fixed assets;

– received fixed assets;

![]() – the cost of fixed assets at the beginning of the year;

– the cost of fixed assets at the beginning of the year;

![]() – the cost of fixed assets at the end of the year.

– the cost of fixed assets at the end of the year.

They characterize the share of incoming (withdrawn) funds to the value at the end (beginning) of the period.

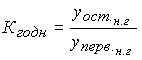

Balance sheets of fixed assets allow you to determine the indicators of the state:

Shelf life:

,

,

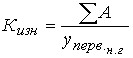

Wear coefficient:

![]() , or .

, or .

They characterize the share of residual value and the share of depreciation of fixed assets.

The study of the dynamics of capital return for a particular institutional unit or industry is carried out using individual indices:

, where

, where ![]() is the return on capital.

is the return on capital.

The dynamics of capital return on a group of institutional units (branches) or on the economy as a whole is calculated using general indices:

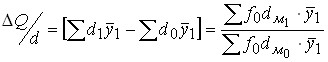

, where

, where  or ,

or , ![]()

where ![]() is the volume of output by a group of institutional units (industry, national economy as a whole);

is the volume of output by a group of institutional units (industry, national economy as a whole);

![]() – average annual value of fixed assets;

– average annual value of fixed assets;

![]() – the share of the value of fixed assets of each institutional unit or industry in their total volume by group.

– the share of the value of fixed assets of each institutional unit or industry in their total volume by group.

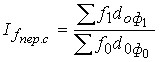

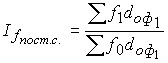

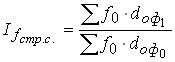

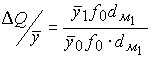

The dynamics of changes in the return on capital is analyzed by a group of institutional units using indices of variable, constant composition and structural shifts:

,

,

;

;  .

.

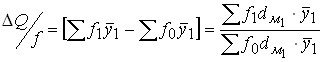

Change in the average level of return on capital due to all factors:

![]() ;

; ![]() .

.

by changing the return on capital in each institutional unit:

![]() ;

;

by changing the share of funds in each institutional unit:

![]() .

.

always ![]() .

.

Absolute change in the volume of production under the influence of factors:

![]() ,

,

where ![]() is the share of machinery and equipment in their total value.

is the share of machinery and equipment in their total value.

![]() , or

, or

![]() .

.

To determine the impact on the absolute increase in the volume of production of the factor of change in the return on capital in each institutional unit, it is necessary to make the following calculation:

.

.

due to changes in the share of the value of fixed assets:

.

.

due to the impact of changes in the average annual value of fixed assets:

.

.

Calculation of product growth due to changes in the indicator-factor:

![]()

![]()

![]() .

.

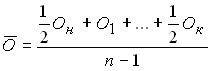

In determining the average volume of working capital, the following formulas are used:

![]() ;

;  ;

;  ,

,

where ![]() is the average annual working capital balance;

is the average annual working capital balance;

![]() – the balance of working capital at the beginning of the year;

– the balance of working capital at the beginning of the year;

![]() – the balance of working capital at the end of the year;

– the balance of working capital at the end of the year;

![]() – time period;

– time period;

![]() is the number of periods.

is the number of periods.

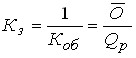

The use of circulating production assets is characterized by a system of indicators:

1) turnover ratio (![]() ) ,

) ,

where ![]() is the volume of sales (GDP);

is the volume of sales (GDP);

2) fixing coefficient (![]() ) ;

) ;

3) the duration of one revolution (![]() ),

),  where

where![]() is the number of days in the period.

is the number of days in the period.

A decrease ![]() in the reporting period means an improvement in the use of working capital, otherwise – a slowdown in their turnover:

in the reporting period means an improvement in the use of working capital, otherwise – a slowdown in their turnover:

,

, ![]() .

.

Let’s determine the impact of the consolidation coefficient and the volume of GDP on the average annual balances of working capital. A change in the fixing coefficient will change as follows: ![]() . Changes in the volume of GDP will change

. Changes in the volume of GDP will change ![]() as follows:

as follows: ![]() .

.

Security questions

What is national wealth? Differences in the definition of national wealth according to the methodology of the SNA and BNH. What are non-financial assets? Composition of financial assets of the national wealth of the country. Options for the evaluation of fixed assets. What are the methods of accruing depreciation on fixed assets? Indicators of movement and condition of fixed assets.