The fundamental method for compiling the balance of payments is the double recording of foreign trade transactions, which is based on the fact that each registered transaction corresponds to a payment in one form or another, and the balance of payments and receipts should converge. The double accounting system used in the preparation of the balance of payments means that each operation in it is represented by two records that have the same absolute value, but different signs (positive in credit, negative – by debit), and their amount should be equal zero.

Most of the balance of payments records relate to transactions in which economic values are provided or acquired in exchange for other economic values. In this case, credit and debit parts in the registration system automatically arise after recording two equal values in articles corresponding to both exchange items. For example, the export of certain goods is recorded in the statistics on goods, and payment for this export is recorded in the statistics of banking operations on changes in the asset and liabilities.

Most of the transactions in the balance of payments relate to transactions that imply a reciprocal flow: this is the exchange of goods, services, financial assets, and investment income.

For example, the exporter received currency for his goods. In this case, one record registers the export of goods, the other – an increase in the currency assets of banks (in the currency account of the exporter) by the same amount. At the same time, the import of equipment of non-residents to pay for the authorized capital of an enterprise created on the territory of the national economy will be registered on debit as import, and on credit – as direct investment in the national economy.

In addition to the above, the so-called transfer operations that do not entail adequate compensation in one form or another (i.e. in the form of goods, services or assets) are also included in the balance of payments. In this case, one side of the operation will be automatically recorded in the trade balance, and the compensation record will be reflected in the transfer column.

For example, humanitarian assistance received by a country will be reflected in the balance of payments for debit (as import) in the trade balance with simultaneous posting on a loan in the current transfer item.

In accordance with the recommendations of the IMF, the preparation of the balance of payments is carried out according to the method of economic operations, when the criterion for accounting for the operation is the transfer of ownership from residents to non-residents and, conversely, as a result of which the various stages of foreign trade operations are taken into account, all requirements and obligations of the country to abroad are reflected, including outstanding ones.

According to the rules of balance of payments statistics, the following operations are recorded on the loan:

under the items of real resources – export, income received from abroad, transfers received from abroad; under items of financial resources – operations that lead to a reduction in foreign assets owned by residents of a given country, or to increase the obligations of a given country.

And vice versa, the following operations are recorded on debit:

under items of real resources – import, income paid abroad, transfers transferred abroad; under items of financial resources – operations that lead to an increase in foreign assets owned by residents of a given country, or to reduce the obligations of a given country.

In other words, for assets, regardless of whether they are real or financial, a positive number (credit) means a decrease in their stock, and a negative (debut) reflects their increase. Accordingly, for obligations, a positive value means an increase, and a negative value means a decrease.

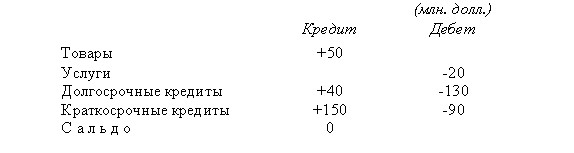

Consider using the double recording method on situational examples of foreign trade operations of Russia and Belarus and their recording in the balance of payments of Russia.

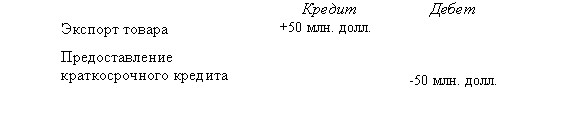

1. Russia sells gas to Belarus, payment for which is made in a few months (on the terms of short-term lending).

Positive credit wiring when exporting gas means an increase in the amount of foreign currency in the accounts of Russian banks.

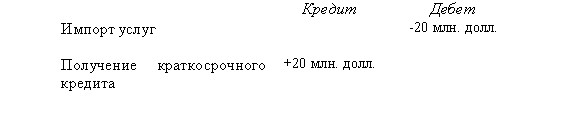

2. Belarus provides Russia with transportation of gas through its territory to Western Europe, which is associated with payment for these services by the Russian side.

A negative balance in the “import of services” column will mean a decrease in the amount on the accounts of Russian banks that will be charged to pay for gas transportation services.

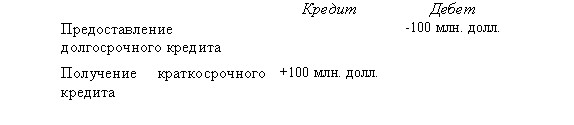

3. Russia provides Belarus with a long-term loan to pay for imports of engines of the Yaroslavl Motor Plant. When making settlements, such a transaction can be reflected as the provision by Russia of long-term loans in exchange for short-term lending to Russia.

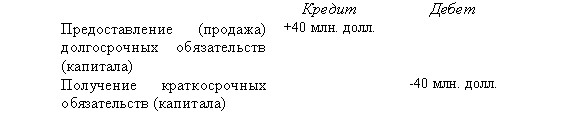

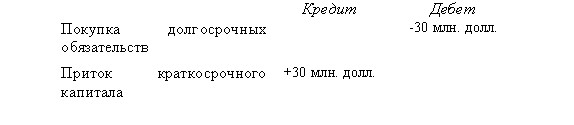

4. A Belarusian company buys shares of a privatized Russian company, which is the acquisition of long-term liabilities. The result of the transaction is Russia receiving funds from abroad.

5. The Russian company acquires a stake in a Belarusian company, as a result of which there will be an outflow of short-term capital from Russia in exchange for long-term obligations of Belarus.

The above situational examples will ultimately be combined in the following resulting table.

Errors and omissions in the balance of payments. The double entry system for credit and debit items assumes the presence of a resulting zero balance of payments. However, in practice, due to the complexity of the full coverage of transactions, price heterogeneity, differences in the time of registration of transactions and other reasons, discrepancies are inevitable, the amount of which balances the total balance of payments and is reflected in the article “Errors and omissions”. As a rule, in developed countries the amount under this article is relatively small and stable. However, it can increase dramatically and reach an impressive amount, which is most characteristic of developing countries (including individual countries with economies in transition). This situation, as a rule, is associated with problems of completeness of statistical accounting or weak currency control in the country. If there are significant amounts passing under this article, the balance of payments data may be distorted and will not reflect the real situation of international settlements.

In this regard, according to the IMF criteria, it is considered that the balance of payments is satisfactory if the amount passing through the “Errors and Tolerances” column does not exceed 5% export or import of a given country (the highest value of one of these indicators is taken into account). Otherwise, it is believed that the balance of payments can have large errors, which reduces its reliability and requires caution in handling data.

On the other hand, it is generally accepted that the presence of large changes in the article “Errors and omissions” can also serve as an indicator of the presence of an unregistered outflow (or inflow) of capital. But this conclusion can only be made in a broad context, using data not only from one balance of payments.