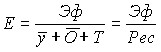

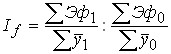

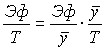

Efficiency is a socio-economic category. Increased efficiency is expressed in the economy of living and materialized labor, saving that contributes to a better and more complete satisfaction of social and personal needs of economic entities. Efficiency is measured by the ratio of the effect (result) obtained to the resources used or the current costs consumed (direct and inverse values):

![]() ;

;  ;

; ![]() ;

;  ,

,

where E is the efficiency of the functioning of the economy;

Ef – absolute economic effect;

Res – resources;

H – current costs.

The economic effect is the final result of economic or financial activities. This indicator can be explosives, gvas, GDP, NPVP, GNI, PND. The result of financial activity is expressed by an indicator of profit. The economic effect is always represented by an absolute value, which can be both positive and negative.

The resources used include labor, fixed assets and revolving funds. The average values of these indicators for the period are used in the calculation.

Current production costs include labor, material and financial costs. Labor force consumption is measured by the indicator of workers’ wages, consumption of fixed assets by depreciation; working capital – the amount of their use in the production process.

The efficiency of social production is measured using a system of indicators, which includes both generalizing indicators characterizing the use of all types of resources (costs), and private ones, reflecting the use of each specific type of resource. There is a generalizing indicator of the effectiveness of the resources used and a generalized indicator of the effectiveness of current costs. A direct summary indicator of the effectiveness of the use of resources:

,

,

where ![]() is the average annual cost of fixed production assets;

is the average annual cost of fixed production assets;

![]() – average annual value of working capital;

– average annual value of working capital;

T – labor resources (costs for training and reproduction of labor.

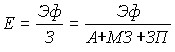

Direct summary of the effectiveness of current costs:

,

,

where A is depreciation;

MoH – the value carried over by working capital and represented by the amount of material costs;

Salary – payroll fund.

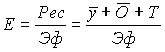

Generalizing performance indicators can be calculated in the opposite way, i.e. by dividing the applied resources or current costs by the economic effect. As a result, performance indicators called resource intensity (cost-intensity) are obtained.

Inverse generalizing indicator of the effectiveness of the applied resources:

.

.

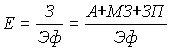

Inverse generalizing indicator of the effectiveness of current costs:

.

.

When studying performance indicators in dynamics, an increase in the effect is revealed due to changes in various components (Ef = E · Res):

![]() ;

;

1) efficiency of use of applied resources:

![]() ;

;

2) the amount of resources applied:

![]() .

.

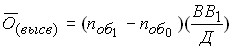

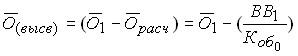

Inverse performance indicators make it possible to determine the savings (overspending) of resources in the reporting period compared to the baseline due to changes in factors (![]() ):

):

1) efficiency of use of applied resources:

![]()

2) the volume of gross output of goods and services

![]()

![]() .

.

There are three particular indicators of economic efficiency:

means of labor (fixed assets); objects of labor (circulating funds); live labor.

Particular indicators of the efficiency of the use of fixed assets can be calculated in relation to the applied and consumed fixed assets:

(a) Direct indicators:

– return of fixed assets

– return of fixed assets

![]() – the return on capital calculated in relation to the annual amount of depreciation.

– the return on capital calculated in relation to the annual amount of depreciation.

Direct private indicators characterize the size of the effect per unit of applied or consumed fixed assets:

b) inverse indicators:

– capital return of the unit of effect

– capital return of the unit of effect

– the capital intensity of the unit of effect, calculated on the basis of the annual amount of depreciation.

– the capital intensity of the unit of effect, calculated on the basis of the annual amount of depreciation.

Inverse partial indicators characterize the size of applied or consumed fixed assets per unit of effect.

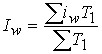

The dynamics of capital return on a group of industries is determined as follows:

.

.

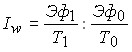

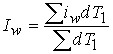

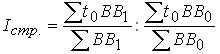

When studying the dynamics of capital return and capital intensity for a group of industries, indices of variable and constant composition and an index of structural shifts are used.

.

.

Particular indicators of the efficiency of living labor (productivity) and fixed assets (capital return) are interconnected by the following dependence:

,

,

where ![]() is labor productivity;

is labor productivity;

![]() – return on capital;

– return on capital;

![]() – capital-labor ratio.

– capital-labor ratio.

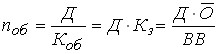

Particular indicators of the effectiveness of the use of working capital can be calculated in relation to the applied and consumed working capital:

(a) Direct indicators:

![]() – turnover coefficient;

– turnover coefficient;

![]() – material output, calculated on the basis of data on consumption for the year of material costs.

– material output, calculated on the basis of data on consumption for the year of material costs.

b) inverse indicators:

![]() is the material intensity of the unit of effect.

is the material intensity of the unit of effect.

If the volume of gross output is taken as an effect, then:

![]() ;

; ![]() .

.

Average duration of one turnover of working capital (number of days during which the turnover lasts):

.

.

Acceleration of turnover of circulating funds leads to the release of a certain part of them from circulation, and the following is calculated:

1)  ;

;

2)  ;

;

3) ![]() .

.

Particular indicators of the effectiveness of the use of living labor:

(a) Direct:

![]() – labor productivity;

– labor productivity;

![]() – labor productivity, calculated on the basis of data from the payroll fund.

– labor productivity, calculated on the basis of data from the payroll fund.

b) reverse:

– labor intensity of the unit of effect;

– labor intensity of the unit of effect;

– salary intensity of the unit of effect.

– salary intensity of the unit of effect.

Dynamics of labor productivity:

.

.

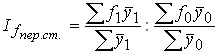

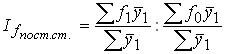

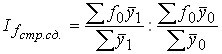

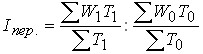

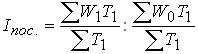

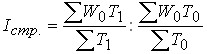

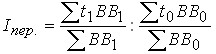

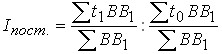

When studying the dynamics of labor productivity in a group of industries, statistics use indices of variable, constant composition and structural shifts:

;

;

;

;

;

;

![]()

The general labor productivity index based on sectoral indices is determined by the formula of Academician Strumilin:

or .

or .

Labor intensity indices:

;

;

;

;

.

.

T:

| Additional explosives resulting from a change in the size of applied resources |

f:

m:

W^

| Additional volume of explosives resulting from increased return on capital (f), material return (m) and labour productivity (W) |

Increasing efficiency means increasing the economic effect and saving the applied economic resources or current costs.

Particular performance indicators are intensive, and the size of resources used or consumed are extensive factors in the efficiency of the functioning of the economy. Extensive factors are associated with the involvement of additional fixed assets and labor resources. Intensive ones ensure the growth of performance through a more rational use of available resources.

The measure of the influence of extensive and intensive factors on the change in the economic effect can be determined using two methods:

the absolute value of the factors; relative importance of factors.

Then the change in explosives due to each extensive and intense factor:

![]() ;

;

![]() ;

;

![]() .

.