The System of National Accounts (SNA) is a system of interrelated indicators and classifications used to describe and analyze macroeconomic processes in market economies.

The introduction of the SNA in the Republic of Belarus is carried out on the basis of the Republican Program for the Transition to the System of Accounting and Statistics adopted in international practice, approved in 1992. The SNA used in the Republic of Belarus is presented in the European version. This version is called the “European System of Integrated Economic Accounts”.

All transactions related to the production process are recorded in the SNA in the production account. The production account is developed for enterprises and industries, sectors, as well as for the domestic economy as a whole in order to characterize the production activities of residents.

This account has several types of representation:

by industry:

Table 29 Resource requirements

Industry | Resources | Use | |

production of goods and services | intermediate consumption | GVA | |

… | … | … | … |

total by industry |

by sector:

Table 30 Resource requirements by component

Uses | Resources |

Intermediate consumption (SD) Total value added (GVA) Consumption of fixed capital (FOC) Net value added (NPV) | Gross output of goods and services (BB) |

GVA and NPV – balancing items

for the economy as a whole:

Table 31

Uses | Resources |

Intermediate consumption (SD) GDP in market prices | Output of goods and services (BB) Net taxes on imported products |

Consider the components of the production account by sector.

Gross output of goods and services (BB) is the total value of all output produced in a year, including the production of goods and services, which may be market and non-market in nature.

The gross output of goods and services consists of the following elements:

release of goods; provision of market services with the exception of imputed products of banks; imputed products of banks; provision of non-market services.

Gross output of goods includes:

the cost of products sold by enterprises to the side; change in work-in-progress; changes in stocks of semi-finished products and finished but unsold products; products manufactured at the enterprise and used for production needs; the value of goods transferred to other enterprises by barter; products credited to remuneration, as well as for non-production consumption in this enterprise; production of agricultural and non-food products for domestic consumption by households; output of goods, except agricultural and food, by households for their own consumption.

Gross output of market services includes those services that are subject to purchase and sale and the production costs of which are covered entirely by the proceeds from their sale. These are transport, trade, material and technical supply, housing and communal services, paid cultural services, health care, and consumer services.

Imputed products of banks are those produced by financial institutions acting as financial intermediaries engaged in the collection, transfer and distribution of financial resources. It is calculated as the amount of income from property received by financial institutions, less interest paid to their creditors. If the bank provides loans to other banks, the gross output for these operations is not calculated.

Non-market services are services whose costs are fully or largely covered by the State budget, voluntary household contributions or property income. Non-market services include services provided to society as a whole, as well as to certain groups of households free of charge or for a nominal fee. These include: government services; public organizations, defense, compulsory social insurance, etc.

Intermediate consumption (PP) is the initial phase of the use of gross output of products produced and services rendered. It represents the value of all goods and market services that are transformed or fully consumed during a given period for the purpose of producing other goods and services. Consumption of the value of fixed assets is not included in intermediate consumption.

The composition of intermediate consumption includes:

material costs (goods and services used in the production process); payment for intangible services; expenses incurred in the interests of production and manufacturers (travel, lifting, expenses for overalls, special food, personal protective equipment, representation expenses, etc.); the cost of ensuring normal working conditions; the cost of training employees; homeowners’ costs for the maintenance of residential premises; indirectly measurable financial intermediation services.

Intermediate consumption does not include the costs of enterprises for valuable things (works of art, precious metals, stones, etc.), as well as the cost of using fixed assets leased from other institutional units, as well as fees for services, commissions.

Intermediate consumption is calculated:

in material production (by industry); in the production of intangible services; market services by industry; non-market services by industry.

Gross value added (GVA) is calculated at the industry level as the difference between gross output of goods and services and intermediate consumption. Gross value added is the balancing item of the production account and an indicator of the contribution to the gross domestic product of individual producers, industries or sectors.

Consumption of fixed assets in the SNA (SCA) represents the value of fixed assets consumed during a given period during normal depreciation and predictable disposal, including insurance losses of fixed assets due to accidents. In order for the consumption of fixed capital to be comparable to other indicators of the production account, its value must be determined at the same current prices that are used to estimate output and intermediate consumption. The amount of consumption of fixed capital may differ significantly from the depreciation recorded in accounting. This difference is due to the presence of inflation.

Net value added (NPV) is defined as the value of the output of goods and services less intermediate consumption and consumption of fixed capital.

Gross domestic product is central to the SNA. Gross domestic product characterizes the value of goods and services produced in all sectors of the economy and intended for final consumption, accumulation and net exports. Unlike the indicator of gross social product (GP) previously adopted in the system of indicators of the balance of the national economy, the gross domestic product (GDP) does not include the value of labor items consumed during its production (material costs for raw materials, materials, etc.). The GP takes into account only the result of the material sphere of activity, while the gross domestic product includes the value of all goods and services produced (market and non-market).

Gross domestic product is the main economic indicator in foreign and domestic statistics and is an indicator of the value of goods and services created as a result of the production activities of institutional units in the economic territory of a given country. Gross domestic product measures the value created by both residents and non-residents in a given country’s economic territory, but does not take into account the value created by residents outside that country.

According to the provisions of the SNA, gross domestic product can be calculated by three methods:

production (at the production stage); distributive (at the stage of income generation); by the end-use method (at the end-use stage).

The calculation of gross domestic product by the production method is to sum up the gross value added of all industries and sectors of the economy. Gross domestic product is calculated in market prices, taking into account taxes payable.

There is a distinction between added value at the level of the industry (sector) of the economy and at the level of the national economy as a whole. Value added at the level of an industry or sector (GVA) differs from the value of the economy as a whole (GDP) in the size of net taxes on products and imports, which can only be determined at the level of the national economy.

Gross domestic product in market prices is the result of the activities of all domestic producers. It is equal to the total gross output of products and services in the domestic economy less intermediate consumption (PP) + value-added tax (VAT), net taxes on products (NPV) and net taxes on imports (NVCs).

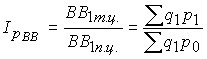

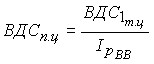

![]() or

or

![]() .

.

In cases where the assessment of the output of goods and services (and GVA) is obtained in basic prices, the relationship between the amount of GVA of industries or sectors of the economy can be expressed as:

![]() , where

, where ![]() – taxes,

– taxes, ![]() – subsidies.

– subsidies.

When the output of goods and services and value added are expressed in producer prices, the relationship between the sum of GVA, industries and sectors of the economy and GDP is determined as follows:

![]() .

.

In order to better understand the content of the concept of GDP, it is necessary to have a clear idea of the types of taxes paid by institutional units.

All taxes in the SNA are divided into:

current (paid regularly); capital (one-time).

Current taxes:

production and import; on income and property.

GVA and GDP are estimated in both current and constant prices. Valuation at current prices is necessary to determine:

the value of goods and services produced; value structure of value added; the proportions between the product produced and the capital investment; other current calculations.

Estimation of GVA and GDP in constant prices is necessary to study the dynamics of these indicators. In this case, the current prices of the period taken as the base are used as constant prices.

There are several methods for calculating GDP and GVA in constant prices. The main methods are:

double deflating method; single deflating method; the method of extrapolating the indicators of the base period using volume indices; A method for revaluing cost elements.

The method of double deflation consists in the fact that the indicators of gross output and intermediate consumption, estimated in the process of current accounting and actual prices, are recalculated using the corresponding price indices into constant prices. The gross domestic product deflator is defined as the ratio of THE volume of GDP at current prices to the volume of gross domestic product in constant prices.

GVA in constant prices is defined as the difference between gross output at constant prices and intermediate consumption at constant prices.

This method is the most accurate and the most common. The recalculation is as follows:

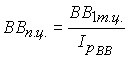

gross output is revalued from current prices to constant ones using the gross output deflator index:

;

;

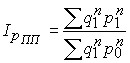

using the deflator index, we determine the gross output of the reporting period in constant prices:

;

;

similarly determined ![]() by intermediate consumption:

by intermediate consumption:

;

;

intermediate product in constant prices:

;

;

we determine GDP in constant prices:

![]()

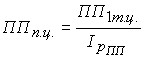

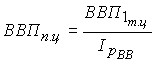

The single deflation method is that the value of production in the current period is divided by the price index, which expresses the change in prices in the current period compared to the prices in the base period, which are used as constants.

When using this method, it is conditionally assumed that the dynamics of prices for intermediate consumption is identical to the dynamics of prices for gross output. This means that the change in the volume of GVA is equated with the dynamics of gross output.

To convert GVA and GDP into constant prices, use the deflator index calculated on gross output:

.

.

This method is used in the absence ![]() of , calculated from the elements of intermediate consumption.

of , calculated from the elements of intermediate consumption.

The extrapolation method allows you to calculate indicators in constant prices by multiplying the value in the base period (GDP or GVA) by the index of the physical volume of gross output.

The conversion of GVA or GDP into constant prices is as follows:

![]()

![]() .

.

The recalculation shall be based on the following equality:

![]() .

.

This method is used when price indices cannot be calculated.

The method of revaluation of cost elements allows you to calculate indicators in constant prices by deflation of cost elements. This method is used in practice to revalue the value of non-market services provided free of charge into constant prices.

When analyzing macroeconomic indicators in dynamics, the absolute increase in the value of GDP is calculated:

![]() .

.

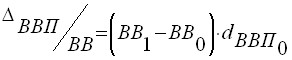

In order to assess the impact of the price on the change in GDP, the following change is calculated:

![]() .

.

To assess the impact of physical volume on the change in GDP, the following dependence is used:

![]() .

.

To analyze the impact on the change in GDP of the volume of gross output and the share of BVN in BB, the following index model is used:

![]() or .

or . ![]()

Consider the impact of the ![]() change

change ![]() on the overall change in GDP for the period:

on the overall change in GDP for the period:

1. Calculate the absolute increase in GDP due to changes in explosives:

.

.

2. Absolute change due to change ![]() :

:

![]() .

.

3. General change in GDP:

![]() .

.

Security questions

How is the production account formed? What elements make up the gross output of products and services? Composition of intermediate consumption. Production method of GDP calculation. Methods of calculating GDP in constant prices.