Methods of measuring the state of the investment climate. To analyze the conditions for the rational use of investments in economic science and practice, the category of investment climate is used. The investment climate of the region is a generalized characteristic of the totality of social, economic, organizational, legal, political, socio-cultural prerequisites that predetermine the process of investing in the regional economic system.

Three approaches to assessing the investment climate can be distinguished:

The first approach is based on the assessment of a set of macro-economic indicators, including: the dynamics of gross domestic product, national income and industrial production; the nature and dynamics of the distribution of national income, the proportions of savings and consumption; the state of legislative regulation of investment activities; the progress of privatization processes; development of individual investment markets, including stock and money markets. The second approach (multifactorial) is based on an interrelated characteristic of a wide range of factors affecting the investment climate. These include: the characteristics of the economic potential (the provision of the region with resources, bioclimatic potential, the availability of free land for productive investment, the level of energy and labor resources, the development of scientific and technical potential and infrastructure); general conditions of management (environmental safety, development of branches of material production, volumes of unfinished construction, degree of deterioration of fixed production assets, development of the construction base); maturity of the market environment in the region (development of market infrastructure, the impact of privatization on investment activity, inflation and its impact on investment activities, the degree of involvement of the population in the investment process, the development of the competitive environment of entrepreneurship, the capacity of the local sales market, the intensity of inter-farm relations, export opportunities, the presence of foreign capital); political factors (the degree of public confidence in the regional authorities, the relationship between the center and regional authorities, the level of social stability, the state of national-religious relations); social and socio-cultural factors (standard of living of the population, living conditions, development of medical care, prevalence of alcoholism and drug addiction, crime rate, real wages, the impact of migration on the investment process, the attitude of the population to domestic and foreign entrepreneurs, working conditions for foreign specialists); organizational and legal factors (the attitude of the authorities to foreign investors, compliance with the law by the authorities, the level of efficiency in making decisions on the registration of enterprises, the availability of information, the level of professionalism of local administration, the effectiveness of law enforcement agencies, the conditions for the movement of goods, capital and labor, the business qualities and ethics of local entrepreneurs); financial factors (budget revenues, as well as the availability of extra-budgetary funds per capita, the availability of financial resources from the republican and regional budgets, the availability of credit in foreign currency, the level of bank interest, the development of interbank cooperation).

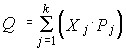

The generalizing indicator of the investment climate with the factor approach is the sum of many weighted average estimates for groups of factors:

, (4)

, (4)

where Q is a generalized weighted assessment of the investment climate in the region; Xj – average score of the j-th factor for the region; Pj is the weight of the jto factor; k is the number of factors to be taken into account.

A composite indicator for assessing the investment climate cannot serve as the only criterion for the attractiveness of a particular economic system for investment. It is usually supplemented by information on the development of certain factors that have a direct impact on the state and dynamics of the investment climate.

The third approach to assessing the investment climate is based on the assessment of the risk of investments. At the same time, as elements that form the investment climate of the region, two areas of connection between investment risks are analyzed: either from the investment potential or from the socio-economic potential.

The first direction was implemented by the specialists of the magazine “Expert”. It is designed primarily for the “strategic investor”. At the same time, the investment potential of the region is assessed on the basis of such macroeconomic indicators as:

availability of factors of production, including labor; the level of consumer demand; the results of economic activity of the population in the region; the level of development of science and the introduction of its achievements into production; development of the leading institutions of the market economy; provision of the region with technical and social infrastructure.

Investment risks are assessed in terms of the probability of loss of investment and income. At the same time, all its varieties are taken into account among the risks: economic, financial, political, social, environmental, criminal and legislative.

The second direction is based on the assessment of the level of the investment climate from the standpoint of the development of the regional social system as a whole. The authors of this option took into account, among other indicators, human potential, the material base of development, the socio-political situation and political risk factors, the state of the economy and the level of its management.

Problems of adequate assessment of the investment climate of the region. The study of domestic and foreign experience in assessing the investment climate shows that a number of important methodological provisions developed by modern economic science are often not taken into account.

1. The investment climate of the country and regions is considered, as a rule, from the position of an abstract strategic investor striving for accelerated, maximum, unimpeded profit, while different investors need their own assessment of the investment climate.

2. As a rule, the recipient of investments and the investor pursue different goals. The first seeks to solve a set of socio-economic problems with a minimum of attracted funds, the second wants to extract the maximum profit and gain a foothold in the markets, in economic systems for a long period. Therefore, the investment climate should correspond to the balance of interests of the participants in the investment process.

3. There is an objective need to interface investments with innovative development factors. This is especially true when attracting investments in the field of small innovative entrepreneurship (venture investment).

4. Investments should be linked to the development of human capital, the growth of the qualifications of workers in all spheres of life, which should be taken into account when creating an appropriate investment climate of the country or its region.

5. A comprehensive assessment of the effectiveness of the use of attracted investments and the favorableness of the investment climate is necessary.

The factor approach to assessing the investment climate is most consistent with most of these requirements. Its advantages include: taking into account the interaction of many factors; the use of statistical data that neutralize the subjectivity of expert assessments; differentiated approach to different levels of the economy in determining their investment attractiveness.

The risky method of analysis and assessment of the investment climate is of interest, first of all, for a strategic investor. It allows him not only to assess the attractiveness of the territory for investment, but also to compare the level of risk inherent in the new investment object with the existing one in the usual business region.

One of the leading areas of modern economic thought – institutionalism – provides new opportunities for analyzing the investment climate. For the purposes of our study, it is important to characterize the institutional conditions of extended social reproduction as special institutional systems.

Investment attractiveness of the region. When studying the comparative investment attractiveness of regions and countries, a wide range of indicators is used, such as the type of economic system, the volume of GDP, the structure of the economy, the availability of natural resources, the state of infrastructure, the state’s participation in the economy, etc. Due to the fact that the investment climate of the regions is influenced by various factors and conditions, many of which are subject to rapid changes, a one-time, one-time determination of the investment climate is not can serve as a guide for making any investment decisions. Therefore, when assessing the investment climate of the regions, it is necessary to conduct regular, periodic observations, i.e. monitoring of the investment climate.

The investment climate of the region was considered as a complex system consisting of three important subsystems:

investment potential – a set of available factors of production in the region and areas of capital application; investment risk – a set of variable investment risk factors; legislative conditions – a legal system that ensures the stability of the investor’s activities.

The investment potential of the region is a quantitative characteristic, taking into account the main macroeconomic indicators, the saturation of the territory with factors of production (natural resources, labor, fixed assets, infrastructure), as well as consumer demand of the population. When calculating the investment potential of the region, absolute statistical indicators are used. At the same time, the total potential of the region includes eight integrated subspecies:

resource and raw material potential, calculated on the basis of the weighted average availability of the region’s territory with balance reserves of the most important types of natural resources; production potential, understood as the aggregate result of the economic activity of the population in the region; consumption potential, defined as the total purchasing power of the population of the region; infrastructure potential, characterized by an assessment of the economic and geographical position and infrastructure saturation of the region; innovative potential associated with taking into account the complex of scientific and technical activities in the region; labor potential, for the calculation of which data on the number of economically active population and its educational level are used; institutional potential, understood as the degree of development of the leading institutions of the market economy in the region; financial potential, expressed by the total amount of tax and other monetary revenues to the budget system from the territory of this region.

Investment risk is a quantitative characteristic that assesses the probability of loss of investments and income from them.

With regard to the region, the following types of risk can be distinguished:

political, depending on the stability (instability) of regional power and political polarization of the population; economic, related to the dynamics of economic processes in the region; social, characterized by the level of social tension; criminal, determined by the level of crime in the region, taking into account the severity of crimes; ecological, calculated as an integral level of environmental pollution; financial, reflecting the intensity of the regional budget and the aggregate financial results of the activities of enterprises in the region; legislative, characterizing a set of legal norms regulating economic relations in the territory (local taxes, benefits, restrictions, etc.).

The procedure for compiling the investment rating of the region includes several stages. At the first stage, of all statistical indicators related to a particular type of investment risk and potential, the most significant indicators are identified with the help of correlation analysis. Then, by the method of factor analysis, the contribution of each significant indicator to the total value of the corresponding potential or risk is determined. At the final stage, using the cluster analysis method, regions ranked by potential (risk) are grouped into groups according to the nature of the investment climate.