The image of modern civilization is radically different from what it was fifty years ago. After the Second World War, despite differences in the level of economic development, all countries were involved in the world system of industrial economy, an integral part of which were the leading capitalist powers, socialist countries, including the Soviet Union, which created a giant industrial empire. At the same time, the periphery was represented mainly by colonial possessions, the remaining part of this system, which provided the world economy with raw materials and energy resources.

Like any new stage in the development of civilization, modern was caused by the birth, development and spread of technical and technological innovations.

Studying the patterns of economic development of industrialized countries, scientists have identified a certain cyclicality in the course of innovation processes and have developed a number of theories that explain the cyclical nature of the development of the world economy. The most common is the theory of “long waves”, developed by N.D. Kondratiev. In this theory, an attempt is made to explain a certain cyclicality in the course of the development of the world economy, periodically repeating 40-50-year cycles of introduction of major industrial innovations. As a result, key industries are changing, the ratios of factors for the location of economic sectors, specific areas of concentration of new industries are emerging.

In accordance with this concept, from the beginning of the industrial revolution and throughout the nineteenth and twentieth centuries, it was customary to distinguish 4 “long waves” (Table 1). Each of them corresponded to its main countries of innovation. In each of these countries, in turn, leading areas of concentration of the newest industries and industries arose, which served as bases for the diffusion of innovations to other areas.

The first industrial period in the development of the productive forces, available for analysis from available sources of evidence, began with an industrial revolution and industrialization and gave rise to the first three technological revolutions, coinciding with long cycles. This period can be called the phase of development of the production of means of production, which was reflected in the outstripping growth of the production of means in comparison with the production of consumer goods. It was in this way that the material and technical base was created for the regulation of economic growth and expanded reproduction, which, due to the initial structural imbalance of the first and second divisions, and, consequently, the contradiction of production and consumption, supply and demand, determined the onset of crises of overproduction. However, until the end of the twentieth century, this contradiction was resolved through the spread of technological revolutions in breadth, in new branches of production, in new countries and regions drawn into the funnel of industrialization, i.e. extensively.

Table 1 Resource requirements by component

Long waves. Conjunctures and technological revolutions

Reproduction phase | Periodization Long Waves | Country | Technological Revolution |

Intermediate phase | 1770–1820 | United Kingdom | Formation of a large machine industry, a new energy industry a base based not on the natural energy of man, animals, water and wind, but on mineral fuels |

1820–1870 | Western Europe UNITED STATES | Railway network as a transport infrastructure connecting the production units of the market | |

1870–1920 | Western Europe, USA, Japan | Electric power grid as energy infrastructure | |

1920–1970 | Western Europe USA, Japan, new industrial Countries (NIS) | Automated conveyor factories instead of factories like combining machines | |

Finite phase Product | 1970–2020 | Western Europe, USA, Japan, NIS, some Developing Country | Information and communication network as an information structure linking producers and users of information and services |

Source: YJSHIHIRO KOGANE. Long Wave of Economic Growth // Futures/ 1988. Oct. P. 536.

In the second industrial period of development of the productive forces, new intermediate products (electricity, synthetic materials, computers, etc.) were created. The main difference between this period and the first is the invention of many end products, including durable goods (cars, electrical appliances, radios, televisions). This period can be conditionally called the phase of production of consumer goods, or final products. If in the first period the entire economic structure was saturated with the means of production and a global structural shift occurred due to the overflow of resources into industry, then in the second period mass production predetermined an adequate transition to mass consumption. This contradiction could no longer be resolved extensively, since production had a limit on the achieved level of social welfare and the payment demand of the working people as the main consumers of the final product. Within this period of industrial development, monopoly capitalism was replaced by a state-monopoly capitalism and a transition to new forms of transnational in scope and “state-corporate” in content capitalism was marked.

At the present stage of development of the productive forces, which at this level of our knowledge can be called scientific and informational, capitalism has received a new impulse of movement. This stage differs from industrial periods not only in the development of world production and consumption, but also in the formation of a new technological paradigm for the ratio of factors of production, including a qualitatively new labor force, tools and objects of labor and a new model of organization and management of social reproduction. This is due to the formation of the information complex, which dramatically changes all the elements of the structure of reproduction and economic growth, forms a new dynamics of the ratio of industries, the relationship between production and consumption and, finally, a new technological mode of production and a long cycle.

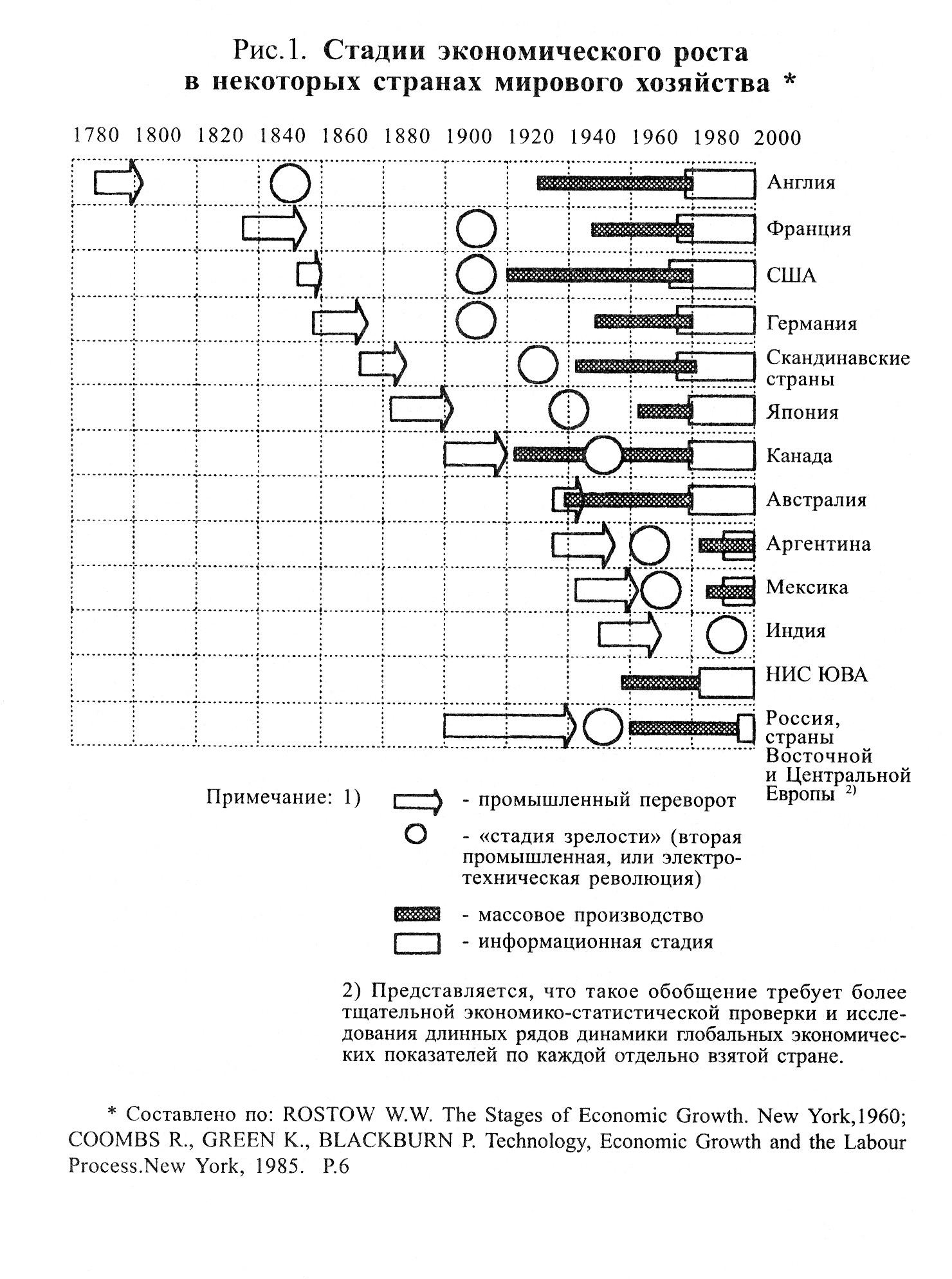

In accordance with the change in the influence of certain factors on the process of economic development of countries, they can be graded by the time of entry into different phases of the development of productive forces with a corresponding transition from one technological mode of production to another (Fig. 1).

The analysis of Fig. 1 confirms the position that countries enter successive stages of economic development and move from one technological revolution to another, regardless of the social system. In addition, the diversity of the passage of stages and stages of development in different countries in the XIII-XIX centuries is also obvious.

The country that first threw a technological challenge to its closest neighbors and the whole world was England, where “a huge rise in production capabilities (in the XIII-XIX centuries.) demanded, if only for political reasons, an adequate response on the continent.”

At the same time, there is a convergence of the timing of the entry of different countries into the same stage, as well as a combination of stages of development due to the increase in the dynamism of economic processes and the intensification of reproduction in the twentieth century.

The basis of the long waves was, according to N.D. Kondratiev, the movement of technical progress from the moment of appearance to the moment of application and development of new industries responsible for the production of means of production, as well as the movement of gold mining. The upward wave of the large cycle is accompanied, according to Kondratiev, not only by an increase in the intensity of small and medium-sized industrial cycles, but also by major social upheavals, as well as the entry of new countries into the world economy, which is not the cause of long waves. Hence, the growth of the pace and intensity of economic dynamics leads to the growth of social contradictions, to the involvement of new territories in the world economy as a result of the aggravation of the struggle for markets and sources of raw materials. The common reason for the large cycle of conjuncture is the development of economic needs or, as they put it.

N.D. Kondratyev “the direction and intensity of scientific and technical discoveries is a function of the requests of practical reality.”

Long waves are an international phenomenon, which can be traced not so much on the example of individual economies, as in the analysis of international production and consumption, as well as the dynamics of world prices for goods and services and other indicators of world economic development. The movement of the parameters of economic growth of individual countries has its own pattern, which depends on the time of the onset of the period of technological revolutions. That is why some states experience a significant economic recovery during the global recession (for example, the newly industrialized countries of Southeast Asia during the world economic downturn that began in the 70s of the twentieth century), or a recession during the global recovery (in the USA and Great Britain in the period 1947-1973).

According to some researchers, at present the world economy is in the initial phase of the fifth Kondratieff cycle, which is associated with the widespread introduction of microprocessors, robots and the success of genetic engineering. By the beginning of the 80s, the technical equipment of production facilities was almost completely updated. The industry received numerical control (CNC) machines, robots, automatic lines, flexible production systems (GPS) of rapid readjustment. In agriculture, biotechnology and genetic engineering began to be introduced. Science received microelectronics and computer science, which greatly facilitated the intellectual efforts of specialists. A new revolution occurred in the field of communications: fiber-optic cables, satellites and parabolic antennas, cellular stations, faxes appeared, which provided the ability to instantly and reliably connect anywhere in the world. The appearance of the Internet in 1990 helped to create a fundamentally new system of communication, which now has an impact on all spheres of human activity, including economic. Every 24 hours, more than $1 trillion is moved to the global financial market with the help of computers. UNITED STATES.

The most important indicator of the transition to a new phase of the “long wave”, the so-called post-industrial stage of development, was the rapid growth of labor productivity and, accordingly, a decrease in the share of people employed in the production sector. The service sector – its size, growth and characteristics – has become the most important indicator of the level and type of development of countries. From this vast “tertiary” sphere, the “quaternary” “sphere of knowledge” is now distinguished – science, computer science, personnel training, culture.

Thus, the “big wave” as a result of the process of penetration of a significant number of technically interconnected objects and tools into production leads to the creation of new technological methods of production, new technological systems. The consistent introduction and penetration into the reproduction of these systems requires a radical reorganization of the production process, special forms of labor, management and planning both at the level of enterprises and on the scale of the entire national economy.

Consequently, there is a transformation of the laws of formation, development and obsolescence of technology, science and technology into the laws of the economy, the laws of intensification of reproduction and economic growth, and in the last quarter of the twentieth century. we witnessed a new round of absorption of technological, organizational and institutional innovations and the formation of a new trajectory of evolutionary development of states and unified regional reproductive complexes of the world economy.

The world economy at the end of the twentieth century is impressive in its scale. Suffice it to say that the total GDP of the planet in 2000 amounted to 30,971.1 billion dollars, and in prices and at purchasing power parity (PPP) 44,002.4 billion dollars. USA (Table 2).

In the course of the previous development of the world economy, a sectoral structure was formed , which is represented by a set of its parts, historically formed as a result of the social division of labor. It is expressed by the share of individual industries and sub-sectors in the total volume of total production (by the cost of production).

Table 2 Resource requirements by component | ||||||

Dynamics of world development, in dollars, in 2000 | ||||||

GDP, billion Usd. | Share in GDP world, % | The pace of the GDP growth,% | ||||

1985 | 2000s | 1985 | 2000 | 1986- 2000 | 2001- 2015 | |

World | 21790,0 | 30971,1 | 100,0 | 100,0 | 2,7 | 3,7 |

Developed countries of the West | 14885,0 | 25558,2 | 54,7 | 52,2 | 2,4 | 2,6 |

UNITED STATES | 5645,0 | 9837,4 | 20,8 | 21,1 | 2,8 | 2,8 |

Japan | 2195,0 | 4841,6 | 8,1 | 7,4 | 2,1 | 2,0 |

Germany | 1395,0 | 1873,0 | 5,1 | 4,6 | 1,9 | 2,4 |

France | 1020,0 | 1294,2 | 3,8 | 3,4 | 2,0 | 2,4 |

Italy | 975,0 | 1363,0 | 3,6 | 3,1 | 1,7 | 2,3 |

United Kingdom | 915,0 | 1414,6 | 3,4 | 3,0 | 2,0 | 2,3 |

Developing Country | 8130,0 | 6059,4 | 29,9 | 40,0 | 4,7 | 4,7 |

PRC | 1115,0 | 1080,0 | 4,1 | 10,9 | 9,6 | 5,5 |

Post-socialist countries, including: | 4175,0 | 746,8 | 15,3 | 7,8 | -1,8 | 4,5 |

Russia | 1685,0 | 251,1 | 6,2 | 2,7 | -2,9 | 5,0 |

Republic of Belarus | 100,0 | 29,9 | 0,37 | 0,20 | – | – |

The macro-sectoral structure of the economy reflects the largest economic proportions: between the production (material) and non-production sphemi, and in the sphere of material production – between the mining industry, agriculture, fisheries, forestry (all combined into the primary sector), manufacturing (secondary sector) and non-production sphere (services), including the credit and financial system, trade, transport and communications, health, education, consumer services, etc. (all included in the tertiary sector), and the information sector, which includes the process of creating, processing, storing and disseminating information, as well as ensuring the functioning of the entire information structure (quaternary sector of the economy), Table. 3.

It is these proportions, first of all, that determine the belonging of a country to the agrarian, agrarian-industrial, industrial, post-industrial, as well as information society.

The latter, as already noted, is being formed literally before our eyes, it is associated with the rapid development of the information sector of the economy and marks the transition of the most developed countries from the “post-industrial” to the “information” or “post-service” society.

For the modern world, the determining factor has become the economic differentiation of countries. The collapse of colonial empires disconnected the liberated states from the system of the traditional division of labor and made the economies of developed countries much more self-sufficient than before. In developed countries, science has become the main productive force. The emergence of high technologies allowed the great powers to abandon the development of their own industrial production at the same pace, transferring a number of primarily labor-intensive, but not very complex industries to the developing countries of Latin America and Southeast Asia.

Table 3 Resource requirements by component | |||

The structure of GDP (in the numerator) and the economically active population (in the denominator) of individual countries of the world in 2000 (%) | |||

S t r a n a | Rural x-vo, mining. industry and other industries (primary sec- torus) | Processing industry (secondary sector) | Services (tertiary sector) |

Economically highly developed (post-industrial) countries | |||

UNITED STATES | 2\2,7 | 23\25,0 | 75\72,3 |

Japan | 1,9\6 | 38,2\33 | 59,9\61 |

GERMANY | 1,1\3 | 28,3\41 | 70,6\56 |

France | 2,4\5 | 26,5\26 | 71,1\62 |

United Kingdom | 1,8\1,1 | 31,4\18,7 | 66,8\80,2 |

Newly Industrialized Countries (NIS) | |||

Brazil | 13\31 | 38\27 | 49\42 |

Mexico | 8\21,8 | 33\21,3 | 59\56,9 |

Republic. Korea | 5\21 | 43,5\27 | 51,5\52 |

Singapore | – | 28\25,4 | 72\74,4 |

Developing countries | |||

India | 30\67 | 25\15 | 42\18 |

Saudi Arabia | 6\5 | 46\25 | 48\70 |

Myanmar | 61\65,2 | 10\14,3 | 29\20,5 |

Burkina Faso | 32\80 | 26\15 | 42\5 |

Centrally planned and transition economies | |||

China | 17,6\53 | 49,3\33 | 33\14 |

Russia | 8,4\13,2 | 38,5\31,8 | 53,1\55 |

Ukraine | 12\20,5 | 26\25,8 | 62\53,7 |

Hungary | 5\8,3 | 30\26,7 | 65\65 |

Poland | 5\26 | 35\29,9 | 60\44,1 |

The world at large | 5,2\47 | 31,4\17 | 63,4\36 |

Compiled by the author according to the data: Competitiveness of the national economy. Foreign trade: status and prospects. –Mn.: National Academy of Sciences of Belarus, Institute of Economics of the National Academy of Sciences of Belarus, FLLC “Law and Economics” 2002. Statistical Yearbook, 2001. – M.: Interstate statistical committee CIS, 2001.

As a result, in the late 80s – early 90s. the world was divided into three parts:

– the first includes developed post-industrial states that occupy leading positions in the field of high technologies and control investment flows;

– the second includes countries specializing in the extraction of raw materials and the supply of agricultural products and dependent due to the weak development of science and technology on post-industrial countries, new technologies, modern machinery and equipment;

– The third group of states emerged as a result of the collapse of the socialist system and the transition of countries to the creation of a market economy. These countries have a fairly high production, scientific and technical potential, but the socio-economic difficulties experienced by these countries during the transition period do not yet allow them to take an appropriate, worthy place in the world economy.

The greatest success in the world economy was achieved by post-industrial countries, but the formation of the modern structure of their economies took place in very difficult conditions.

The formation of the post-industrial system was prepared by the rapid economic growth of the 50s – 60s. This growth led to an increase in the well-being of the population of developed countries, allowed more funds to be directed to the development of science and new technologies. In turn, the application of the achievements of STP led to a change in the structure of production and employment. If in 1955 in the United States in the manufacturing industry and construction up to 34.7% of the total labor force was employed and about 34.5% of GNP was produced, then from the beginning of the 60s the situation began to change, and by 1970 the share of the manufacturing industry in GNP fell to 27.3%, in employment – to 25.0. At the same time, the importance of the service sector has increased. In the early 70s, most researchers who considered the formation of a post-industrial society spoke of it as a society based on services.

Another important feature of the modern era has become the progress of science and education. Thus, in the two decades since the end of the Second World War, US spending on R&D has increased by 15, and spending on all types of education by 6 times, although the GNP itself has only tripled. In 1965, the U.S. spent 10% of GNP on R&D and education.

The result of this process was a change in the traditional model of the economy. The role of extractive industries and agriculture has sharply decreased, with a relatively stable role of industry in GNP and employment, but the “tertiary” sector for the first time took one of the dominant places in the structure of farms in developed countries and surpassed the “primary sector” in its importance.

The consequence of this process was the transfer of the production of a number of mass goods by American, European and Japanese companies beyond national borders, which laid the foundations for the newly industrialized NIS countries. The development of new energy- and commodity-saving technologies has made developed countries less vulnerable to their Third World suppliers.

Thus, the formation of the first prerequisites for the transition to a post-industrial society paved the way for a sharp decline in the role of the primary sector both in the economies of developed countries and on a global scale. In conditions when the tertiary sector becomes an absolutely dominant sphere of social production, the primary sector finally loses its former importance.

By the beginning of the 70s, there was a situation in which, for the first time in history, the integrity and balance of the world industrial system was violated. And if earlier the capitalist economy was characterized by cyclical crises of overproduction, then during this period the negative phenomena in the economy were the result of the first systemic crisis of the industrial economic model. Under the current circumstances, the industrial sector has taken the place of the agrarian sector as the next potential victim of technological progress.

The beginning of the first systemic crisis is associated with the “oil” crisis of 1973, when oil prices began to rise, by January 1974, opec member countries doubled oil prices. As a result, the total value of oil entering the US market increased from $ 5 billion in 1972 to $ 48 billion in 1975, with a slight reduction in supplies.

Prices for other raw materials have also increased: coal – by 20%, nickel – by 60%, copper – by more than 70%.

By July 1, 1980, the price of oil had reached a record $34.72. per barrel (which in today’s prices is more than $ 60 per barrel).

As a result, for the first time in the post-war years, a serious inflationary wave arose in developed countries. Prices have risen, the cost of living has increased (for example, in the United States by 133%), unemployment has increased.

An attempt to remedy the situation by adjusting the interest rate without radically changing fiscal and tax policies has failed in the U.S. and other developed countries.

The end of the 70s was one of the most dramatic periods in the history of Western countries. The main danger at that time came not from the military-strategic power of the USSR (as well as its allies), but from the very imperfection of the industrial system, which requires more and more resources and raw materials for its development. Its dependence on foreign markets turned out to be so significant that in 1974 the leaders of the “third world” quite seriously raised at a meeting of the UN General Assembly the question of establishing the so-called “New International Economic Order”. In fact, in an ultimatum form, Western countries were invited to join a series of specially designed trade agreements that determined the prices of most basic natural resources, to unilaterally abandon the vast majority of tariff restrictions on imports of products from developing countries, and to amend patent laws so that the transfer of modern technologies to developing countries became as cheap as possible.

However, the consequence of these negative events for developed countries was the acceleration of the structural restructuring of the economy, a course was taken to develop non-material-intensive industries and reduce the industries of the “primary” sphere. Between 1973 and 1978, oil consumption per unit value of manufactured output fell by 2.7 percent year-on-year in the United States, by 3.5 percent in Canada, 3.8 percent in Italy, 4.8 percent in Germany and the United Kingdom, and 5.7 percent in Japan, and oil demand in 1979 first revealed the same degree of elasticity as most consumer goods. Between 1970 and 1983 in the United States, the share of agriculture in total GNP fell by 19%, construction by 30%, while the share of service industries grew by almost 5%, including trade – by 7.4%, and telecommunications – by 60%. The consequence of this was an increase in the attention of entrepreneurs to the markets for those products, the consumption of which could grow without encountering the saturation of demand. The structural crisis has given further dynamism to new industries such as telecommunications and electronics; increased the demand for education and health services; Structural changes continued at an increasing pace: from 1975 to 1990, the share of people employed in American industry fell from 25 to 18% of the labor force, while over the previous 15 years it decreased from only 27 to 25%; From 1982 to 1992, the share of tangible assets in the book value of American companies decreased from 62% to 38%, while the share of information products and intellectual capital increased from 37 to 61%.

Structural adjustment has also led to a slowdown in economic growth. If between 1965 and 1973 the economies of the industrialized countries developed at a rate of about 5% per year, then in 1974 growth slowed to 2%, remaining at this level for the next decade. The growth rate in the sphere of material production decreased especially noticeably from 3.21 to 0.71%. However, the consequence of these negative processes was the long-term prosperity of economically developed countries. The main efforts and funds in these countries were directed to the development of new technologies, the introduction of the achievements of NTP into production, although this did not lead to rapid GDP growth, like the development of mass production, but ensured the absolute technological dominance of developed countries.

By the beginning of the 90s. members of the “big seven” owned 80.4% of the world’s computer equipment and provided 90.5% of high-tech production. The U.S. and Canada alone accounted for 42.8% of the world’s R&D spending, while Latin America and Africa combined accounted for less than 1%.

A new stage in the development of post-industrial society began in

Since then, all Western countries have entered a period of steady growth of the information sector of the economy, which has become the basis of economic progress. It can be argued that this stage is characterized by the invulnerability of the post-industrial world, developing on a solid internal basis.

The economic recovery of 1992-2000, which became the longest in the history of the United States, marked the beginning of the stage of development of Western countries, in which they act as formed post-industrial systems. According to experts, in the 90s, more than 70% of the growth of their gross national product was determined not in the purely material sphere of production, but due to the improvement of the educational level of workers, the spread of new information technologies.

By early 1995, information technology in the United States produced about three-quarters of the added value created in industry, and American manufacturers controlled 40% of the global communications market, about 75% of the turnover of information services and four-fifths of the software market. All this has become a reality because from the middle

In the 80s of the twentieth century, the United States demonstrated a fundamentally different type of economic growth than their main rivals.

Exports of services from developed countries reached almost $ 900 billion, while for all other regions of the world this figure did not exceed $ 200 billion .

At the same time, it should be noted that the industrial component of the economy of developed countries was not only not destroyed, but also remained virtually unchanged, the share of industrial production throughout the period remained relatively stable, and technological progress also proceeded, first of all, from the needs of the industrial sector.

Today, in most post-industrial countries, GNP growth rates are increasing, and the leadership of the United States in the world economy is becoming undoubted. If in 1989-1995 the average annual growth rate of the American economy was 1.9%, then in 1996-1998 productivity in the American economy increased by an average of 1.4% per year, and in 1995-1999 this figure was already 2.9%, in the first half of 2000 the productivity growth rate exceeded the growth rate of GNP and reached 5.2% – the highest figure in the last 17 years.

Similar trends are characteristic of Western European countries. Here, since the beginning of the 90s, there has been an increase in the growth rate of GNP. According to the Handelsblatt Euroland Barometer, economic growth in the euro area reached 3.4% in the second and 3.5% in the third quarters of 2000, which is the highest figure for the 90s.

The first systemic crisis of the industrial type of the economy minimized the importance of the “primary sector” of the economy and stimulated the rapid growth of the “quaternary sector”. Developing countries specializing in the production of primary sector products and the exploitation of their natural resources, after an unsuccessful attempt to “force” influence the emerging post-industrial world, found themselves in a subordinate position to those countries whose economies are dominated by the “tertiary sector”.

In recent years, a number of researchers have begun to single out even the “five” sphere of “golden collars” – the apparatus of public and private management, consulting firms and other “directors”.

A characteristic feature in the development of the modern world economy is globalization. IMF experts define globalization as “the growing economic interdependence of countries around the world as a result of the increasing volume and diversity of international transactions in goods, services and global capital flows, as well as due to faster and wider diffusion of technologies.” Transnational corporations (TNCs) play a major role in the globalization of business. TNK is a super-large association of institutions and enterprises that takes part in the control of production and circulation simultaneously in many sectors of the economy on a global scale.

TNCs began to form already in the 60s. Their power and international influence began to grow so rapidly that the UN created in 1972-1975 a special permanent Center for TNCs, monitoring their activities and trying to regulate them.

TNCs have a complex structure, which is headed by a network of research institutes, design bureaus. They are located in the country – the founder of TNCs and reliably protect themselves from possible encroachments and industrial espionage of competitors. Numerous branches are scattered around the world, focusing on raw materials, energy, labor, environmental benefits or markets. The structure of most TNCs includes powerful trading companies – trading, mass media, advertising agencies, banks.

The competitiveness of TNCs extends to all the industries in which it operates, allowing it to focus all its financial, intellectual and advertising power on the “breakthrough industries” as necessary and compensate for losses in some industries by increasing profits in others. In the United States in 1960, only 7 corporations operated in more than 10 industries; in 1980 there were already more than 100 such corporations, and the 10 largest of them united enterprises of more than 20 industries each.

The main role in the globalization of the world economy belongs to TNCs of North America, Western Europe and Japan (Table 4). These three centers of the world economy account for about 77% of world industrial production, and TNCs in the countries of these regions provide 82% of the total output of all TNCs, of which there are about 44 thousand in the world, and the number of foreign branches is 280 thousand.

Table 4 Resource requirements by component | |

Distribution of the world’s 500 largest multinational corporations by country in 1999 | |

S T R A N A | Number of corporations |

UNITED STATES | 179 |

EUROPEAN UNION | 148 |

Japan | 107 |

Canada | 12 |

South Korea | 12 |

Switzerland | 11 |

China | 10 |

Australia | 7 |

Brazil | 3 |

Mexico | 2 |

Norway | 2 |

Russia | 2 |

India | 1 |

Malaysia | 1 |

South Africa | 1 |

Taiwan | 1 |

Venezuela | 1 |

Source: The Fortune Global 500.

TNCs control up to 90% of the world market of coffee, wheat, corn, iron ore, timber, 85% of the copper and bauxite market, 80% of the tea and tin market, 75% of bananas, crude oil. The economic power of TNCs is comparable to the GDP of medium-sized states, they have a serious impact on the economic policy of countries, since under their control are often not only the largest enterprises, but also entire sectors of the national economy of countries.

The economic power of TNCs is evidenced by the annual volume of sales (or income). Thus, the annual sales of the American company General Motors are 1.2 times higher than the GDP of such a developed country as Norway. The annual income of the largest TNCs is measured in hundreds of billions of dollars. For example, the level of annual revenues of the American company Exxon is only slightly inferior to the volume of Australia’s GDP. And the amount of income of the seven largest companies of TNCs in the world exceeds the GDP of Canada , a country included in the “big seven”.

TNCs account for more than half of today’s global industrial output. The largest TNCs are the main levers of management of world industry, centers of strategic decision-making.

The global economic performance of TNCs helps to save time and resources. In response to fluctuations in supply and demand, multinational companies move the production of certain products from factory to factory around the world and thereby minimize downtime. Extending the life of most of their products, these companies first organize their production in the fashion-sensitive rich world, and at a later stage – in less rich and developed countries. Similarly, the life of the equipment is extended – it is transferred to less developed parts of the world.

TNCs have played and continue to play a very special role in world production and in international trade, controlling 1/3 of the production of world GDP, 1/3 of world foreign trade, up to 4/5 of the world’s licenses and patents and more than 90% of foreign direct investment. The total turnover of TNCs (together with subsidiaries) in 2000 amounted to about $ 7 trillion.

The share of intra-company turnover between different divisions of TNCs (at tariff prices) today accounts for about 1/3 of world trade, and this share is growing. At the same time, TNC exports also account for about 1/3 of world exports. Consequently, 2/3 of world trade depends on the activities of TNCs. And exports, for example, of the United States are 80% determined by TNCs.

TNCs play a major role in the diffusion of technical and technological innovations, as about 9/10 of the volume of R&D carried out in the industry of market economies is carried out in their systems or on their behalf.

TNCs are intermediaries for the exchange of knowledge, bringing together specialists, scientists, who, as a rule, could not otherwise meet with each other. Thus, production experience and knowledge with the help of multinational companies freely cross state borders and become a global asset.

The modern transition in the development of the world economy from the industrial to the post-industrial (informational) stage is accompanied by a change in the principles of organization of production in the

TNCs – from methods based on the conveyor production system (standardization, simplification and unification of individual production processes during mass production) to methods that orient production to increasingly specific consumer needs. For example, the revenues of General Motors already in the early 90s. 40% were formed due to services – the issue of plastic cards, lending, insurance operations, etc. In the category of “non-industrial” to date, the shoe company “Nike” (more than half of the turnover of which falls on the service sector) and the giant for the production of beverages “Pepsico” are included. This concern ranks first among companies in the catering industry, more than three times ahead of the second-placed McDonald’s in terms of trade turnover.

The desire of the management of the largest TNCs for global restructuring and strengthening their strategic positions was the main motive for the significantly intensified in recent years of international mergers and acquisitions. Such transactions characterize the strategy of TNCs – investing in those industries, the activities within which will be able to provide the company with competitive advantages in the market.

In general, the growth of TNC activities in all sectors of the world economy is associated with a tendency to deepen the internationalization and globalization of economic life.

However, it is impossible not to notice that in parallel with globalization in the world economy there is a process of regionalization. Regionalization has received the greatest expression in the intensification and success of regional integration, both economic and general political. There are currently 85 regional trade and economic agreements in force in the world. Especially far advanced in this direction are the regions of developed countries, primarily Western Europe and North America.

In these regions, the confrontation has already completely exhausted itself, and transnationalization of capital makes it possible to divide regional markets through relatively civilized competition, and world markets – even by combining the efforts of regional participants. The most successful regional economic organization not only in Europe, but also in the world can be considered the European Union, created in 1957, which united at the end of the twentieth century. 15 states with a population of 370 million people. Currently, it accounts for 40.5% of world trade turnover.

Important, from the point of view of economic power, is NAFTA – the North American Free Trade Agreement, concluded between the United States, Canada and Mexico and entered into force on January 1, 1994. at the end of the twentieth century. it covered a region with a population of 390 million people, the organization accounts for 20% of the total world trade.

In Latin America, in 1991, the Mercosur group emerged, uniting Argentina, Brazil, Paraguay and Uruguay with a population of about 200 million people. On January 1, 1995, the transformation of Mercosur from a free trade zone into a customs union was announced, which means not only the liberalization of mutual trade, but also the harmonization of common customs tariffs for third countries. In addition, the countries participating in this agreement, in addition to establishing a free exchange of goods, declared its extension to services, capital and labor. In North and Latin America , the development of the integration process “in breadth” continues, with consideration of the admission of new members to NAFTA and Mercosur, as well as negotiations either for the unification of the latter or for the formation of an even larger integration region, which will include the same countries of North America and a large number of Latin American states.

An important promising area of integration in the world is the Asia-Pacific region. Here the Asia-Pacific Community (APEC) is gaining strength, including 21 countries, including the United States, Japan, Canada, Australia, New Zealand, a large group of countries in East and Southeast Asia, as well as Russia, China and Oceania. As the integration grouping of APEC is still being formed, the unification processes here are carried out more at the micro level. It is actively searching for the most acceptable forms of economic and political cooperation. Nevertheless, it is believed that by 2020 the Community will be the world’s largest free trade area, surpassing both Western Europe and North America in terms of total GDP.

Within the Asia-Pacific Community, there are regional groupings. The most significant of them is the Association of Southeast Asian Nations (ASEAN), established in 1967. The objectives of the organization are to accelerate economic growth, social progress and cultural development through joint action in a spirit of equity and partnership. Most of the countries of the group are characterized by unusually high rates of economic development. By 2003, it is planned to create a developed free trade zone.

Integration processes are also underway within the framework of the CIS, established in 1991. cooperation is carried out in the political, economic, environmental, humanitarian and cultural fields; promoting comprehensive and balanced economic and social development of the CIS countries within the framework of the common economic space.

In general, it should be noted that globalization and regionalization have really changed the face of the world economy. The world economy is a set of national and regional economies interacting in a huge economic space in the conditions of the international division of labor (MRT), in various forms of market activity at the macro and micro levels on the basis of agreed rules and standards of competition. The economies of individual sovereign states have become so interconnected that it is almost impossible to reproduce in isolation from each other.

Economic growth has accrued to mankind at the cost of huge environmental and natural resource costs. For 40 years (1950 –1990) humanity has lost 20% of its fertile layer (annual losses averaged 24 billion tons), which has become very noticeable in some of the most important agricultural areas of the world. During the same period, about the same amount of tropical rainforest was lost, the carbon dioxide content in the atmosphere increased by 13%, which led to an increase in summer temperatures on the planet.

The world economy is not isolated, it operates within a global ecosystem that has limited capacity to produce clean water, form a soil layer and absorb pollutants. It follows that economic growth cannot continue beyond some of the limits determined by the physical parameters of the Earth’s biosphere. It is necessary to move to environmentally sustainable economic development, which means the inevitability of limiting the growth in the consumption of material resources, significantly increasing the efficiency of using water, energy and other resources, meeting the needs of society with the help of their smaller volume with less damage to the environment.