The timber industry complex (LPK) includes forestry, harvesting, mechanical processing and chemical processing of wood.

The timber industry complex of Belarus includes more

5 thousand enterprises (in 1990 there were less than 4 thousand of them), and about 4000 of them are large and medium-sized, consisting on an independent balance sheet. The enterprises of the timber industry produce 6.4% of all industrial products of Belarus. This is the highest figure among the CIS countries (in multi-forest Russia, the timber industry complex accounts for 4.4% of all industrial products, in Ukraine – 2.0%, Moldova – 1.1%, in other CIS countries – less than 1%). The leading place in the timber industry of the republic is occupied by the woodworking industry – more than 87% of the total number of enterprises.

The timber industry complex of Belarus is represented mainly by the Bellesbumprom concern, which is a monopolist in the harvesting of wood and the production of a number of products from it. Mechanical processing of wood is well developed, but the production of chemical-mechanical, chemical processing has almost not received its development at all. As a result, in some types of raw materials there is a chronic shortage, in others – a surplus, the resources of secondary raw materials are used irrationally. As a result, 1/3 of the harvested wood is used as fuel, and most of the whole small wood and waste in logging and timber processing is not used.

In terms of the output of final production per unit of wood raw materials, Belarus lags far behind the USA, Canada, Sweden, finland. Per 1000 m3 of harvested wood in the republic, 3 times less products are produced than in the USA.

Translated into roundwood, Belarus imports more than 1 million m3 of wood from Russia. The import of timber from Siberia leads to a significant increase in the price of final products. For this reason, it can become uncompetitive not only in foreign markets, but also in the domestic one. In market conditions, Belarus can count only on its own timber base, and it is quite sufficient (Table 8.7).

In connection with such a favorable situation, the main task of the development of the timber industry complex of the republic is to increase the level of integrated use of forest resources and achieve world indicators of timber production per unit of harvested wood.

Table 8.7 Resource requirements by component

Balance of forest resources of the Republic of Belarus

as of 1.01.2000, mln. m3, [5, p.198]

Index | Volume |

Availability of wood raw materials by type: | |

timber harvesting | 11,3 |

wood waste | 2,8 |

unaccounted part of the wood pulp | 2,08 |

Altogether | 16,18 |

Importation of timber | 1,79 |

Altogether | 17,97 |

Use of wood raw materials by type: | |

industrial timber | 7,9 |

firewood | 3,1 |

wood waste | 2,8 |

unaccounted part of the wood pulp | 1,03 |

Altogether | 14,83 |

Export of timber outside the republic | 1,53 |

Altogether | 16,36 |

Excess of the presence of wood over its use | 1,61 |

Forestry. The total area of the forest fund of Belarus is 9.09 million hectares, including 7.85 million hectares covered with forests, or 36% of the country’s territory. Great damage to the forests of the republic was caused by the disaster at the Chernobyl NPP, after which 1.7 million hectares of forest land were contaminated. Every year, forestry suffers losses of $ 120 million from the consequences of the disaster. UNITED STATES.

The total forest fund of Belarus consists of state forests (80.7%).

According to the national economic purpose, forests are divided into two groups: forests, which are located in reserved hunting farms and educational and experimental forestry enterprises (35% of the forest fund area), and operational forests (65% of the forest fund area). In the future, the area under the forests of the first group will increase.

According to the main categories of land, the area of the forest fund is distributed as follows: forest area – 90.8%, including covered (87%) and not covered (3.8%) with forest; 3.2% of the land is not used.

Most (65.4%) of the forest area of the republic is covered with coniferous forests, 34.6% – with deciduous forests. Pine prevails among coniferous species (54.5%), spruce occupy about 11% of the forest fund, among soft-leaved (30.7%) – birch (18.5%). The composition of the rocks does not correspond to the optimal. Thus, the area of hardwood is 1.5-2 times less than the possibilities of nature and the economic interests of the state. It should be noted that only the species structure of the forests of the Grodno region approached the optimal, but the area of hardwoods here is insufficient – 3.5%. Almost half of the oak trees are located in the Gomel region. Until 2015, the share of conifers is projected to grow to 73%, and soft-leaved – a decrease to 22%. The species composition of the forest will be close to the recommended optimal structure.

As a result of long-term extensive exploitation of forests, there is a sharp disproportion in their age structure – young animals occupy 36.5% of the forested area, ripe

forests – only 5% (Table 8.7). The implementation of forest management rules will increase the productivity and quality of forests: the real increase in the stock per 1 hectare of mature forests, which in 2010 will be 275, and in 2015 – 290 m3 / ha, or 75% of the optimal volumes (today 56-60%). Every year, about 11 million m3 of own wood (87% of the needs) are used with a total forest stock at the root of 1 billion m3. In terms of roundwood, more than 1 million m3 of wood from Russia is imported to Belarus. In order to fully meet the needs for wood from our own resources, the following is necessary: to improve the structure of its consumption; increase the use of logging and woodworking waste (while about 2 million m3 of them are used, in the future it is possible to increase this volume by 2.5 times); more comprehensive use of wood raw materials of poor quality.

Predictive natural dynamics and the implementation of a competent strategic policy in the forest sector guarantee the practical inexhaustibility and increasing role of this resource, the full satisfaction of domestic needs and increasing the export opportunities of Belarus in forest products, the preservation and growth of many global biosphere, sanitary-hygienic, aesthetic and other “weightless” functions of the forest. True, today the forest sector plays a rather modest role in the economy of Belarus: occupying 40% of the territory of the republic, the forest and its primary products make up only

3.5–5% of GDP, but, taking into account the real dynamics of forests and the recognition of their biospheric role, this may amount to at least 50–60% of GDP [8, p.120].

Forestry is currently 70% financed by the state budget. With the creation of the Ministry of Forestry (August 2004), it is planned to reach the self-sufficiency of the industry by 2007-2008. To do this, it is necessary to equip enterprises with modern equipment, which will allow to produce a semi-finished product of high quality and the final product. Taking into account the fact that the Baltic countries – major importers of Belarusian timber – within the EU will increase the depth of processing of raw materials and try to independently enter the Western market with the final products. In order not to remain a raw material appendage, Belarus is also forced to increase the competitiveness of its products.

At first, it is planned to increase the income of the industry by reducing the share of wood sold at the root and several times increase revenues from logging of the main use.

Logging industry. Its products are wood materials, which are used depending on the quality and size for production and construction needs (business wood) or as fuel (wood). Annually harvested 6.9 million m3 of industrial timber,

0.9 million dense m3 of firewood (wood growth of 20 million m3 per year). The demand for industrial timber is met by local production by about 94%. In terms of harvesting volumes, the districts of Minsk, Vitebsk and Gomel regions are distinguished, which have large forest reserves. They produce almost 3/4 of all wood (Tables 8.8, 8.9, 8.10).

Table 8.8 Resource requirements by component

Age structure of forests of Belarus, %, [2, p.202]

Forest age group | Forest area by groups of species and ages | |||

Coniferous | solid-leaved | soft-leaved | altogether | |

Young animals | 41,1*/41,6 | 40,8/40,8 | 27,7/24,3 | 36,7/36,5 |

Middle-aged | 40,6/40,4 | 35,1/35,1 | 52,8/55,5 | 44,4/44,2 |

Chorus | 14,7/14,4 | 14,8/14,8 | 13,0/13,7 | 14,2/14,2 |

Ripe and overgrown | 3,6/3,6 | 9,3/9,3 | 6,5/6,5 | 4,8/5,0 |

*Numerator – as of 01.01.1994, denominator – as of 01.01.2000.

Table 8.9 Resource requirements by component

Availability of timber reserves and location of production of the timber industry complex of Belarus by regions as of 1.01.2001, [2, p.202]

Region | Reserve | Production of products of the timber industry complex | Share of timber industry production in the total volume of industrial production,% | ||

mln. m3 | % | mln. m3 | % | ||

Brest | 141,4 | 12,9 | 33651 | 15,7 | 9,8 |

Vitebsk | 196,9 | 18,0 | 15594 | 7,3 | 3,4 |

Gomel | 248,9 | 22,8 | 52564 | 24,6 | 10,3 |

Grodno | 115,8 | 10,6 | 22939 | 10,7 | 6,5 |

Minsk | 229,1 | 21,0 | 69458 | 32,5 | 5,4 |

Mogilev | 161,1 | 14,7 | 19621 | 9,2 | 5,1 |

Total in Belarus | 1093,2 | 100,0 | 213828 | 100 | 6,4 |

Table 8.10 Resource requirements

Lumber production and timber export

by regions of Belarus as of 1.01.2001, %, [2, p.205]

Region | Lumber | Timber removal | |

altogether | including business | ||

Brest | 19,1 | 16,1 | 14,6 |

Vitebsk | 12,1 | 19,7 | 20,8 |

Gomel | 16,8 | 19,6 | 20,8 |

Grodno | 13,8 | 8,9 | 8,3 |

Minsk | 13,3 | 19,6 | 18,8 |

Mogilev | 4,4 | 16,1 | 14,6 |

Minsk | 20,5 | – | – |

Total in Belarus | 100,0 | 100,0 | – |

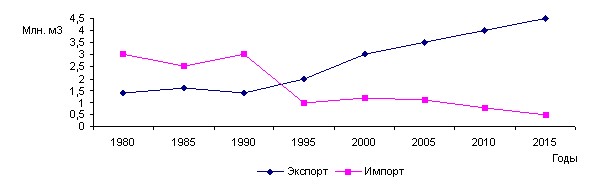

But the main processes of harvesting are not fully mechanized. The general level of mechanization of labor is no more than 50%. In this regard, the main task is the introduction of a system of machines and mechanisms at all stages of production. Until 2010-2015, the total stock of wood on the root is projected to grow to 1.4 billion m3, and the reserves of mature wood – up to 185 million m3, which will allow annual harvesting of at least 20 million m3 of wood. It is realistically possible to increase the share of timber exports to 6–8 million m3 (2005). The main consumers of forest products are Poland (36.9%), Ukraine – (21.7%), Finland (18%) [8, p.118], fig. 8.2.

Rice. 8.2. Actual and forecast dynamics of import and export

forest materials

The woodworking industry is engaged in the treatment of

work and processing of wood, gives about 60% of the gross output of the forest industry. It mainly specializes in the production of sawmill materials, furniture, fiberboard (fiberboard) and particle boards (chipboard), matches, door and window blocks, parquet, plywood, sports equipment, etc. The main commodity resources of the woodworking industry are formed in Mogilev (57.8%), Vitebsk (24.5%); Chipboard – Gomel (33.5%), Vitebsk (40.5%); plywood – in Gomel (24.9%), Grodno (24.2%), Mogilev (25.1%) and Brest (19.4%) regions (Table 8.11).

Table 8.11 Resource requirements

Production of plywood, paper and cardboard in Belarus

as of 1.01.201, [2, p.205]

Region | Number of companies | Specific weight in production, % | ||||

plywood | paper | cardboard | plywood | paper | cardboard | |

Brest | 1 | – | – | 19,4 | – | – |

Vitebsk | – | 1 | – | – | 10,9 | 4,3 |

Gomel | 2 | 2 | 1 | 24,9 | 47,1 | 37,9 |

Grodno | 1 | 1 | 2 | 24,2 | 17,5 | 23,4 |

Minsk | 1 | 1 | 2 | 6,4 | 12,8 | 10,0 |

Mogilev | 1 | 1 | 1 | 25,1 | 11,7 | 24,4 |

Total in Belarus | 6 | 6 | 6 | 100,0 | 100,0 | 100,0 |

Almost 70% is occupied in the industry by the furniture industry. There are 11 associations for the production of furniture in Belarus. The largest – “Bobruiskdrev”, “Minskmebel”, “Gomeldrev”, “Vitebskdrev”, “Mostovdrev”, “Pinskdrev” – produce furniture of various designs. The leader is the Gomel region (Table 8.12). Belarus does not meet the demand of the population in these products. The deficit can be reduced through the development and implementation of products and sets of furniture for various functional purposes on the basis of a unified system of unification and standardization, the introduction of new materials and promising technologies by organizing production in an optimal mode.

Table 8.12 Resource requirements

Furniture industry of Belarus as of 1.01.2001

[2, p.205]

Region | Specific gravity, % | |

by number of enterprises | for the production of furniture | |

Brest | 18,4 | 13,3 |

Vitebsk | 13,2 | 10,0 |

Gomel | 10,5 | 28,1 |

Grodno | 8,8 | 8,0 |

Minsk | 16,7 | 10,2 |

Minsk | 17,5 | 15,0 |

Mogilev | 14,9 | 15,4 |

Total in Belarus | 100,0 | 100,0 |

In the structure of export goods of the industry, the share of the furniture industry today is about 45-50%. Belarus also has a large plywood industry, which began to develop at the beginning of the XX century. for its development in the republic there are raw materials (alder, birch). The largest production of plywood is located in the Gomel, Grodno and Mogilev regions, which account for approximately 75.0% of the total plywood production in the republic (Table 8.12).

To date, the capacity of the woodworking industry is focused mainly on the processing of large and medium-sized wood of high quality. Despite the limited forest exploitation fund, it has the ability to steadily increase production due to the wider introduction of secondary wood resources into the chemical-mechanical and chemical processing.

In the woodworking industry, the most promising area of development is the attraction of foreign investment. Foreign investors prefer to create joint ventures in the forest sector. The main advantage of Belarus over other CIS countries is not only the presence of high potential of forest resources

(in terms of reserves of stands per capita, our country is 3 times higher than the average European level), but also a safe situation in criminal terms.

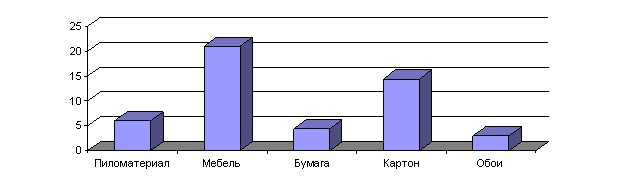

Currently, there are 16 joint and foreign enterprises of the woodworking industry in Belarus, which produce about 7% of lumber, 15% of cardboard, more than 21% of furniture from their national output, as well as other goods (Fig. 8.3).

Rice. 8.3. Share of products produced by joint ventures and foreign enterprises in the total volume of its output in the Republic of Belarus, [2, p.207]

Rice. 8.3. Share of products produced by joint ventures and foreign enterprises in the total volume of its output in the Republic of Belarus, [2, p.207]

The main direction of development of the woodworking industry is the integrated use of wood through the introduction of low-waste and non-waste technologies. Particular attention is paid to the production of new products competitive in the foreign market – medium-density fiberboard of the MDF type, large-format plywood, highly artistic sets of furniture with facade elements made of solid wood, export-oriented types of wallpaper.

Pulp and paper industry. It accounts for 23% of all products of the complex. It specializes in the production of high-quality types of paper, cardboard, cardboard containers, notebooks, wallpaper, various types of cellulose and other by-products (ethyl alcohol, fodder yeast, rosin, turpentine, etc.).

In Belarus, there are 8 largest enterprises for the production of paper, cardboard, working on imported pulp and its own wood pulp. These are paper mills in Dobrush, Shklov, Borisov, Chashniki, a cardboard and paper factory in Slonim, cardboard – in Olkhovka, Pukhovichi, Raevka. The largest producers are The Gomel and Grodno regions (Table 8.12). A pulp and paper mill has been operating in Svetlogorsk since 1968. A significant part of the pulp that is used for the production of paper is imported. There is a possibility of reorienting production to its own raw materials (wood waste, small-scale wood), which will reduce the import of goods of the pulp and paper industry.

Timber chemical industry. Its share in the structure of the complex is about 2.0%. It is represented mainly by the extraction of resin. Processing is carried out at the Borisov Paper and Timber Chemical Plant. The main products are rosin and turpentine. In recent years, the extraction of resin has been declining, because significant areas of ripe pine have been withdrawn from the operational fund. This trend will continue in the near future. Therefore, the timber chemical industry of Belarus is introducing technologies with new stimulants, the level of mechanization is increasing, and the use of raw materials is improving.

Intensive use of chemical stimulants allows to bring the extraction of resin to 200 kg / ha. The volume of its production depends on the raw material base, which is practically not developed.

In 2000, for example, out of 106,500 hectares of pine plantations (the possible share of seedlings), only 36,600 hectares, or 34.4%, were used. In 1985, there were 26 resin plants in Belarus, now only 12 are functioning. And all of them are focused only on the production of charcoal. Resin and turpentine are not produced, since the harvesting of pneumatic osmol has been discontinued. The same situation is with tar for medical purposes and other products of forest chemistry (Table 8.13).

Table 8.13 Resource requirements

Dynamics of timber chemical production in Belarus, [2, p.210]

Type of product (in tons) | 1985 | 2000 |

Resin prey | 12125 | 7300 |

Harvesting of spruce serrovka | 52 | – |

Stump osmol preparation, thousand m3 | 21,3 | – |

Production: | ||

Charcoal charcoal | 3175 | 800 |

Turpentine | 520,1 | – |

Resin | 1563 | – |

wax mail | 1745 | 50 |

pakli resin | 1021 | – |

The intensity of use of forest resources in Belarus is low: about 1% of the total stock and 48.8% of the average annual increase are used annually [8, p.77]. This state of the forest fund makes it possible to increase the volume of logging, more fully meet the needs of the national economy in wood, and in the future to expand the export of forest materials (Table 8.10; Fig. 8.2).

At the same time, the Council of Ministers of the Republic of Belarus, having approved in 1999 the Concept for the Development of the Timber Industry Complex of Belarus until 2015, noted that the current production structure of the complex is imperfect and needs to be optimized taking into account the dimensional and qualitative characteristics of wood raw materials and the needs of the national economy in the products of its processing. Having a significant resource potential, it does not yet provide comprehensive harvesting and processing of all wood raw materials, partially underutilizes the estimated cutting for the main use. For example, in 2000, 1408.5 thousand m3 were underused. As a result, the state budget lost significant revenues, and forestry lost additional sources of financing. In addition, such management leads to the accumulation of overgrown forests, which are characterized by reduced current growth and poor sanitation, which ultimately adversely affects the productivity and marketability of forests.

According to forecast calculations, a noticeable increase in the estimated cutting is expected until 2015. So, according to the main use, in 2005 it should be 7 million m3, in 2006-2010 – 9.0, in 2010-2015 – 10.7 million m3. The total size of forest use in 2010-2015 may amount to more than 19 million m3 of liquid wood, the capacity of the domestic market is expected to be in the volume

14-15 million m3 of wood. Exports of round timber, sawn timber, plywood and furniture in terms of roundwood may amount to 4.5-5 million m3.

Taking into account the current state and opportunities for the forecast development of the timber industry complex, it is necessary to implement the following areas:

creation of powerful integration structures (corporations, holdings, financial and industrial groups) capable of developing high-tech industries, rationally using the full potential of harvested wood raw materials, and successfully competing in foreign markets; improvement of tax, financial and pricing policies to stimulate investment activity in the industry aimed at its structural restructuring in the direction of priority development of production for chemical and chemical-mechanical processing of wood raw materials; increasing the harvesting and processing of low-value wood and secondary wood resources for heat and electricity in order to reduce imports of non-renewable energy carriers (oil, gas); stimulating the export of deep wood processing products and curbing the export of unprocessed wood raw materials; ensuring state support for projects for the creation (development) of export-oriented and import-substituting industries operating on local wood raw materials, through their priority lending, provision of state preferences and guarantees.

The main parameters of the timber industry complex

(2001):

Number of enterprises, units | 5000 |

Share in the volume of industrial production, % | 6,4 |