A powerful impact on the economic dynamics is exerted by the expenditure part of the budget, which in turn depends on the revenue mechanisms of the budget. Taxes form the bulk of the revenue part of the state and local budgets. Hence the priority attention of any state to the formation of the tax system and tax policy. The size of the tax rate and the total mass of resources withdrawn to the state budget have a direct impact on the dynamics of the socio-economic development of society.

A tax is a compulsory withdrawal by the state or local authorities of funds from individuals and legal entities necessary for the performance of the state’s functions. These fees are made on the basis of state legislation.

The use of taxes as an instrument of centralized influence on the economic development of the state has a long history as commodity-money relations develop. The first monetary tax on citizens was introduced in the Roman Empire in the II century. The development of exchange and economic civilization is accompanied by the displacement of other types of payments, including in kind, by taxes.

In modern conditions, taxes perform the following functions:

fiscal – the formation of resources of the state, territories (states, republics) and local authorities to finance the relevant expenses. This function is designed to contribute to the nationalization of part of the national income and the creation of the material foundations for the functioning of the state; distributive – redistribution of revenues between state and local budgets, distribution of the tax burden between social groups; regulating – a selective change in tax rates, which allows to purposefully influence the rates of economic growth, structural restructuring of social production, the accumulation of monetary capital, inflation, the movement of investments, employment, the formation of aggregate effective demand; control and accounting – accounting for the use of economic resources, incomes of firms and households, production volumes, the direction and size of the movement of financial flows; stimulating – reducing tax rates, introducing benefits that contribute to the creation of prerequisites for increasing business activity (increasing the necessary volumes of production, its renewal, increasing investments, savings, conducting R&D), encouraging certain types of entrepreneurship, attracting and moving foreign investment; restrictive – restraining the development or location of production of certain types of products, protecting certain industries by restricting the import of goods.

The totality of taxes, fees, duties and other payments levied in the state, as well as the forms and methods of their construction and collection, forms the tax system. With the change in the forms of state structure, the tax system is also changing, which can be two- or three-tier. For example, in Germany and the United States, it operates at the state, regional and local levels.

The principles that the tax system should meet according to A. Smith include neutrality, fairness and simplicity of calculation. (Smith A. Research on the Nature and Causes of the Wealth of Nations. – M.: Sotsgiz, 1935. T. 2. P. 341–343). These principles have not lost their relevance to date. The neutrality of the tax system lies in ensuring equal tax standards for tax payers. Unfortunately, in countries with economies in transition, this neutrality is virtually non-existent. Wide tax differentiation, a variety of benefits for industries and firms discredit society and undermine economic stability.

The principle of fairness provides for the possibility of equivalent withdrawal of tax funds from various categories of individuals and legal entities, without infringing on the interests of each payer and at the same time providing sufficient funds to the budget system.

The principle of simplicity involves the construction of a tax system using a set of such functional tools for determining taxable income, tax rate and tax amount that are understandable to both tax collectors and taxpayers.

In countries with a federal structure, the principle of even distribution of the tax burden across individual regions and subjects of the federation is widely used in the formation of the tax system.

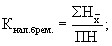

Quantitatively, the level of the tax burden can be represented by the ratio of the amount of taxes per capita to solvency, or the amount of tax remaining after tax to solvency.

where ![]() is the average amount of taxes per capita;

is the average amount of taxes per capita;

DH – income of the population after taxes;

GON – solvency of the population.

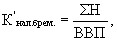

It is possible to calculate the level of tax burden by the share of taxes in the gross domestic product:

where K” nal.brem. – coefficient or level of tax burden;

H – the amount of taxes;

GDP – gross domestic product.

The latter method makes it possible to make comparative comparisons of the tax burdens of individual countries. And therefore it is recommended by the international organization UNESCO.

Methods of construction and collection of taxes, their elements are determined by the relevant legislative acts. Among the elements of taxation are:

the subject of the tax is a tax payer, legal entity or individual who is legally obliged to pay tax; tax bearer – the person actually paying the tax. The allocation of this element is explained by the fact that the tax burden is sometimes actually shifted from the subject of the tax to the consumer of products through the price mechanism (when paying value added tax, excise tax, etc.). Often the subject and the bearer of the tax coincide; the object of tax is income or property from which the tax is charged (profit and income; the value of certain goods; added value on products, works, services; property of legal entities and individuals; transfer of property (donation, inheritance); operations with securities, etc.); the source of tax is the income of the entity, at the expense of which the tax is paid (profit, wages, interest, rent); unit of taxation – a unit of measurement from the object of tax (rubles, meters, liters, etc.); tax rate – the amount of tax per unit of taxation of the object or is set in a fixed amount (the absolute amount per unit of taxation). There are marginal, average, proportional, progressive and regressive tax rates. The marginal tax rate is the share of additional (taxable) or incremental income that has to be paid in the form of tax. The average tax rate is the total amount of tax paid in relation to the total amount of taxable income. This is the tax rate on all taxable income. The tax rate is considered progressive if its average rate rises as income increases; regressive, if the average rate decreases as income grows; proportional, if the average rate remains unchanged regardless of the size of the income; methods of levying taxes – cadastral (involves the use of a cadastre (register), which contains a list of typical objects (land, houses, etc.), classified by external signs and establishes the average profitability of the object of taxation; withdrawal of tax until the owner receives income (income tax from individuals); withdrawal of tax after receiving income (the taxpayer submits a declaration to the tax inspectorate, i.e. an official statement on the income received, and the tax authorities, based on the size of the object of taxation and the current rates, the amount of tax is established).

There are several classifications of taxes. Depending on the method of collection, taxes are divided into direct and indirect.

Direct taxes are payments levied directly on individuals and paid on their income. The source of such taxes are profit, dividends, interest, inheritance, etc. Direct taxes include: income tax from legal entities on corporate profits, tax on income from cash capital and on income from savings, tax on capital and property (property, on personal wealth, on inheritance and gift, on capital gains), income tax on individuals.

Indirect taxes are paid indirectly through the prices of goods and services at the time of their purchase. They are installed on consumer goods, transport services, and the service sector. Their advantage is that the amounts charged are taken at a convenient time for the payer and in the most convenient way. However, indirect taxes are included in the costs of production and added to the prices of goods and services. In this regard, prices are raised and taxes are shifted depending on the degree of elasticity of supply and demand for this product, for the final consumer. The main indirect taxes are consumption taxes (VAT, sales tax, excise taxes), fiscal monopoly taxes and customs taxes.

In order to assess the fairness and equality of tax collection from taxpayers, in countries with market economies, the concept of progressive taxation is used, i.e. the ratio of the amount levied in the form of income tax to the amount of income. In this regard, the taxation system distinguishes: proportional (indicates that the absolute amount of tax is proportional to the income of the employee), regressive (means an increase in the tax in percentage terms as the employee’s income decreases) and progressive (indicates that in percentage terms the tax is set the higher the higher the income) taxes.

According to the sphere of distribution, taxes are divided into national and local. The national taxes include taxes that enter the state budget and form it by 85-90% (taxes on exports and imports, customs duties, most of the income and income tax). Local taxes include taxes received by local budgets, which form it by an average of 70% (land tax, tax on the owners of buildings, part of the value added tax, income and profit tax).

From the point of view of the use of the funds received, general and specific taxes are allocated. General taxes do not have a specific purpose in terms of their use. They are used to finance capital and current expenditures of both the state and local budgets. Specific ones are intended for their use for strictly defined purposes (Emergency tax for the elimination of the consequences of the Chernobyl accident, deductions to the pension fund, etc.).

A fairly large part of the tax amounts levied is provided by income taxation. Income tax is levied on individuals and legal entities, is a function of disposable income and is progressive. This type of tax is not levied on the entire gross income of the payer (total income from various sources), but only on taxable income received after legally stipulated deductions from it. Deductions include production, advertising, travel, transportation and some other expenses, as well as a number of tax benefits (non-taxable minimum, discount on the income of persons with dependents, disabled people, social insurance and social security benefits, alimony, pensions, etc.).

Personal income tax refers to progressive taxes: the tax rate rises as income increases. The object of taxation is the personal income of citizens, adjusted taking into account deductions. The latter include a number of tax benefits (social insurance and social security benefits, pensions, alimony, benefits stipulated in the law) and indexation of the non-taxable minimum. Currently, there is a transition to progressive taxation of the total income of citizens on the basis of universal declaration of income.

In accordance with the Law of the Republic of Belarus of December 20, 1991 “On Taxes and Fees to the Budget of the Republic of Belarus”, enterprises, regardless of their form of ownership, are subject to the following types of taxes.

Income tax on legal entities (income and income tax). It is progressive and is a direct tax. Taxable income is formed after deducting production, transport, advertising, travel expenses from the gross income of the enterprise. In addition, deductions include a non-taxable minimum, benefits to enterprises in the form of accelerated depreciation and some others. All enterprises are subject to income and income tax. This tax focuses on the fulfillment of the stimulating function of the taxation system.

Value Added Tax (VAT) is the second most important tax. It is a relatively new form of taxation and affects the economic behavior of producers and consumers. Value added includes wages, depreciation, profit, interest on credit, electricity costs. VAT is an indirect tax included in the wholesale price, as a result of which the buyer is its payer. In this regard, it is regressive in nature for the final consumer. VAT rates range from 10 to 20%.

Excise duty is levied on products that have monopoly prices and stable demand in their specifics. This is an indirect tax that is included in the price of goods, increasing it. According to the method of withdrawal, excise taxes are divided into individual (for tobacco, wine and vodka products, gasoline, etc.) and universal (turnover tax). The object of taxation is the proceeds from the sale of products, the carrier of excise duty is the buyer. Excise rates are differentiated by type of goods. Real estate tax refers to direct taxes and is paid for the use of production and non-production funds, objects of new and unfinished production. Budgetary organizations are not subject to this type of tax.

An environmental tax is levied on enterprises for the volume of extraction of natural resources and emissions of pollutants into the environment. The tax is differentiated depending on the size of the excess of production and emissions in excess of the established limits and can be levied in three or five times.

It should be noted that the tax systems of developed countries, built on the basis of fundamental principles, imply the widespread use of incentive incentives. The most important of them are the investment tax credit, accelerated depreciation, a discount on the depletion of subsoil during the extraction of natural resources and a number of others. An investment loan is essentially an indirect financing by the state of capital investments of private entrepreneurship through tax exemption for the period of return on capital expenditure. Basically, it is designed for the introduction of innovative technologies, the replacement of obsolete equipment, the production of competitive products. The amount of benefits calculated as a percentage of the value of the equipment is deducted from the tax amount and not from the taxable income. This reduces the cost of newly purchased equipment by the amount of the discount.

With accelerated depreciation, the state allows depreciation to be written off on a scale significantly exceeding the real depreciation of fixed assets. In fact, this is nothing more than a tax subsidy to the entrepreneur. An increase in depreciation deductions reduces the amount of profit taxed, and this accelerates the turnover of fixed capital.

The tax system, built taking into account tax incentives and rational tax rates, provides the effect of the stimulating function of developing production and increasing the tax base. On the contrary, an unjustified increase in rates creates conditions for a decrease in production volumes and “evasion” from paying taxes.

An example of large-scale measures to stimulate the general economic situation is a major reduction in tax rates in the early 80s of the XX century. in the United States. The theoretical substantiation of this program was the calculations of the American economist A. Laffer, who proved that reducing tax rates to the maximum optimal value contributes to the rise in production and income growth. According to the reasoning of A. Laffer, an excessive increase in tax rates on corporate income reduces their incentives for capital expenditures, slows down NTP, and slows down economic growth. The graphical display of the relationship between budget revenues and the dynamics of tax rates is called the “Laffer Curve” (Fig. 5.1).

In the figure on the axis of the ordinate, tax rates R are deferred, on the abscissa axis – revenues to the budget V. With an increase in the tax rate R, the state income as a result of taxation V increases.

The optimal size of the R1 rate (the optimal is the tax withdrawal of 30-40% of profits, but not more than 50%) provides the maximum revenues to the state budget V1. With further tax increases, incentives to work and entrepreneurship fall, and with 100% taxation, the state income is zero, since no one wants to work without receiving income. Consequently, the increase or decrease in tax rates has a slowing or stimulating effect on the dynamics of the socio-economic development of society, which should be taken into account by the state in tax policy. The tax system of any state is not inherently static, but quite dynamic. It is periodically reviewed and reformed. This is explained by the fact that governments use taxes as a regulatory tool and develop a holistic tax mechanism that affects the processes of formation, distribution and use of taxes, the organization of regulation by economic processes at the micro and macro levels. In order to implement tax policy, governments choose forms of tax impact, which are divided into direct and indirect, stimulating and restraining.

In addition, governments use a wide range of methods of tax regulation of the economy at the micro and macro levels, among which are methods related to:

• with the types, rates, structure of taxes (introduction of new or increase in the rates of existing taxes; manipulation of the amount of tax rates in a certain territory or over a certain period of time; change in the structure of taxes; use of a progressive taxation system; differentiation of tax rates by industries and types of production; use of various systems of corporate income taxation);

• with benefits and discounts, including those that encourage business activity, stimulate capital migration, the development of export production, entrepreneurship, R&D, etc. (benefits and discounts on personal income of taxpayers; accelerated depreciation system; investment tax credit; benefits for individual industries and companies, discounts on profits of small businesses and unprofitable enterprises, deductions from the tax base of R&D expenses, benefits in the taxation of capital gains; incentives for private investment in shares, incentives for job-creating enterprises; benefits for foreign investors in “offshore zones”, tax havens, etc.);

• harmonization and unification of national tax systems (unification of rates for leading types of taxes, tax structures).

The tax system of Belarus, corresponding to the conditions of the market economy, is in the process of formation. This is embodied in the selection of leading forms and types of taxes, the determination of rates, the development of the structure of national and local taxes, the definition of the functional orientation of taxation, the testing of various forms and methods of tax regulation, etc.

In accordance with the current Law “On Taxes and Fees Levied on the Budget of the Republic of Belarus”, taxes include: VAT, excise taxes, income and income tax, payments for the use of natural resources (environmental tax), real estate tax, customs duties and charges, land fees, state duty and fees, emergency tax.

Revenues of local budgets of the regions and the city of Minsk are formed at the expense of income tax revenues of enterprises and organizations of communal property, public organizations, consumer cooperatives, collective farms, cooperatives and other farms, real estate tax paid by communal property enterprises and legal entities, state duties, income tax on citizens, VAT, excise taxes, land fees, tax on the use of natural resources, forest income.

Taxation in our country performs mainly a fiscal function and is aimed at expanding budget revenues. In this regard, the tax system is characterized by high tax rates and the general level of tax exemptions from the production of various forms of management and the predominance of indirect forms of taxation. In 1999, corporate income tax was 25%, income tax – from 15% to 60%, income tax from citizens – from 9% to 30%, VAT – 20%, etc. The fiscal function is mainly performed by such indirect taxes as VAT and excise taxes (according to statistics of the same year, they amounted to 44.9% in the budget).

However, in conditions of high inflation, the effectiveness of the indirect form of taxation is sharply reduced. In addition, with a commodity deficit, the predominance of indirect taxes causes the occurrence of negative consequences. Indirect taxes contribute to higher prices, exacerbate inflationary processes, stimulate the process of shifting taxes from producers of goods to end consumers. This situation predetermines the need to reform the taxation system, the priority areas of which are to strengthen the role of income taxation, reduce tax rates for leading types of taxes and the progressivity of taxation, and privilege certain types of activities and products.