The term inflation (from the Latin inflatio – swelling) was first used in North America during the Civil War (1861-1865) and denoted the process of swelling of the paper and money supply. Inflation is a multifactorial phenomenon that manifests itself in the overflow of the sphere of circulation with paper money in excess of the needs of commodity turnover, which causes the depreciation of the monetary unit and an increase in the general price level in the country. However, not every change in the prices of individual goods necessarily leads to inflation. It can be caused by an improvement in the quality of products, terms of foreign trade, and other factors.

In contrast to inflation, deflation refers to a general fall in prices and costs. A slowdown in price growth is called disinflation.

The causes of inflation are manifold and can be divided into internal and external. External causes include a negative balance of foreign trade and payments balances, unfavorable conditions on the world market, for example, falling prices for exported goods and rising prices for imported products, as well as an increase in external debt.

Among the internal causes of inflation are the deformation of the national economic structure, the increase and simultaneous decline in the efficiency of capital investments, the lag of consumer sector industries, shortcomings in the management system, in the mechanism of money circulation, and the lack of anti-inflationary regulation.

In the economic literature, the following types of inflation are distinguished:

Depending on the “depth” of state regulation of the economy, the tools of anti-inflationary policy, inflation can proceed in an explicit or depressed form. The process of inflation in an explicit or open form is manifested in rising prices, a decrease in the exchange rate of the national currency, etc. Suppressed inflation proceeds in a hidden form and manifests itself in a decrease in product quality, a change in the structure of the assortment, an increase in the deficit in the economy, and an increase in queues. Depending on the object of research, national, regional and world inflation is distinguished. On a national and regional scale, the object of analysis is the dynamics of wholesale and retail prices, the GNP deflator in any country, at the level of the association of countries, in the international market (for example, the EU). Depending on inflationary impulses in relation to the system caused by internal and external factors, imported and exported inflation are distinguished. If the country maintains a fixed exchange rate, any increase in the prices of imported goods will import inflation into the country. The importance of this factor in the development of the inflationary process in the country depends on the share of foreign trade in the total GNP. The higher it is, the greater the effect of “importing” inflation. Depending on the growth rate of prices: up to 10% per year, moderate or creeping inflation is distinguished. With growth from 10% to 200% per year, they note haloping inflation or “Latin”. Over 200% – hyperinflation (according to the American economist F. Kegan – over 50% per month). This criterion for dividing inflation is quite conditional. To determine what type of inflation is observed – moderate, galloping or hyperinflation, it is necessary to find out how much the existing rates of price growth change the parameters of social reproduction. Usually, creeping inflation does not have a serious negative impact on the reproduction process. The presence of galloping inflation indicates the emergence of disproportions in the structure of the economy. Hyperinflation occurs during periods of serious disturbances in the proportions of reproduction, when the economy is close to collapse. At the same time, from the analysis of the development of world inflation, it is clear that the country’s economy can adapt to a very large (up to 1000%) rate of price growth. An example is some Latin American countries in the 70-90s and Belarus in the 90s. Depending on how successfully the economy adapts to the rate of price growth, inflation is divided into balanced and unbalanced. In the first case, prices grow moderately and steadily. All other macroeconomic indicators are changing almost adequately. With unbalanced inflation, the prices of goods jump up at different times, and the economy does not have time to adapt to changing conditions. Depending on the ability of the state to influence the inflationary process, it is divided into controlled and uncontrollable. In the first case, the state can slow down or accelerate the growth rate of prices in the medium term. In the second, there are no real sources for adjusting the inflation rate. Depending on the change in the GNP indicator with the growth of demand in the economy, true and imaginary inflation are distinguished. With imaginary inflation, there is an increase in real output, overtaking the growth of prices (growth in the real volume of GNP). At the second stage, as the pressure of demand increases, costs increase, money circulation disorder, stagnation of production (growth of nominal GNP). Depending on the accuracy of the forecast of economic agents regarding the future rates of price growth and the degree of adaptation to them, predicted and unpredictable (unexpected) inflation are distinguished. Depending on the factors that generate and feed the inflationary process, inflation of “demand” and inflation of “costs” are distinguished.

Demand inflation occurs when the demand for goods and services cannot be satisfied by supply both in the national economy as a whole and in the sectoral context. An excess of aggregate demand may arise due to the expansion of the volume of government orders, an increase in household spending on consumption due to the use of previously accumulated liquid funds, an increase in private spending on investment, and an increase in incomes due to wage growth.

In all cases, inflationary pressures will be felt only if the economy comes close to full utilization of all available capacities: unproductive resources are involved in production, some of them become inaccessible, trade unions are taking increasingly tough positions on raising wages. Finally, when the productive capacity of the economy is exhausted completely, any increase in aggregate demand immediately leads to higher prices.

The basis of cost inflation is the relationship between unit costs and prices: an increase in costs, other things being equal, reduces the profitability of production, leads to its reduction and a decrease in the volume of supply in the national economy, which in turn raises prices.

Cost inflation can be caused by several reasons:

§ wage growth – arises in the conditions of strong pressure of trade unions on entrepreneurs. If wages grow faster than productivity, price increases will inevitably occur. At the same time, prices and wages, having begun to grow, draw each other into the inflationary spiral “wages-prices”. It manifests itself in the fact that workers seek higher wages in an effort to compensate for rising prices. The growth of production costs with a constant rate of profit increases the price of products. As a result, workers are demanding an even greater increase in nominal wages, and the process is developing in a circle. It was difficult to break such a spiral, since demand was constantly growing and there was full employment in the economy;

§ increase in profits – appears if firms raise the prices of finished products without reducing production costs;

§ a sharp increase in the price of raw materials, which forces the entrepreneur to increase costs and, as a rule, the price of the finished product (commodity inflation). This type of inflation is sometimes referred to as supply shock inflation;

§ liberalization of prices for certain services after a long blocking;

§ changes in the field of taxation (for example, if the income tax rates are too high and do not stimulate the entrepreneur to expand production). This type of inflation is called tax inflation;

§ organizational restructuring of the economic mechanism (when entrepreneurs, trying to secure their business and compensate for future losses, raise prices for products). This type of inflation is called price cap inflation.

Thus, cost inflation can occur in all cases of price increases without the presence of excess aggregate demand in the economy.

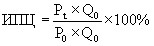

To quantify inflation, the consumer price index is used. It is calculated on the basis of a market basket of goods and services consumed by the average urban family, and is periodically revised, reflecting changes in consumer spending. Thus, the consumer price index can be determined by the formula:

,

,

where P is the price of consumer goods in the consumer basket;

Q – the volume of consumer goods in the consumer basket;

t – current period;

0 – base period.

To determine the rate of inflation, you can use the following formula:

![]() ,

,

where CPI is the consumer price index in the current period;

CPI0 is the consumer price index in the base period.

The price level is inversely proportional to the purchasing power of money. In addition, there is the so-called “rule of 70”, which allows you to calculate the number of years for which prices will double. To do this, the figure of 70 must be divided by the annual level of inflation. So, if inflation is equal to 10% per year, then the prices of goods will double in 7 years.

The consequences of inflation are manifold, contradictory and are as follows.

First, it leads to the redistribution of national income and wealth between different groups of society, economic and social institutions in an arbitrary and unpredictable way. Funds are redistributed from the private sector (firms, households) to the state. The state budget deficit, which is one of the factors of inflation, is covered through an inflation tax. It is paid by all holders of real cash balances. It is paid automatically, since monetary capital depreciates during inflation. Inflation tax shows a decrease in the value of real money balances.

Another channel for redistributing income in favor of the state arises from the monopoly right to print money. The difference between the amount of denominations of additionally issued banknotes and the cost of printing them is called seigneurage. It is equal to the amount of real resources that the state can receive in exchange for printed money. A seigniorage is equal to an inflation tax when the population maintains the real value of its cash balances constant.

Fixed income earners suffer losses from inflation as a result of declining real incomes. Groups receiving indexed incomes are protected from inflation to the extent that the system of income indexation allows them to maintain real earnings. Sellers of goods and resources that occupy a monopoly position in the market can increase their real income.

Owners of real assets (real estate, antiques, works of art, jewelry, etc.) are most protected from inflation, since the rise in prices for these goods overtakes the general inflation rate in the country.

With a constant interest rate, as a result of unexpected inflation, lenders always lose and borrowers win. Trying to reduce losses, banks raise the interest rate. This, in turn, reduces the amount of investment in production. The continuation of this situation in the long term will lead to a reduction in the real volume of GNP and an acceleration of inflation.

Under a progressive taxation system, inflation contributes to increased withdrawals from households. Since inflation leads to the depreciation of savings in monetary form, the redistribution of accumulated income from the old to the young members of society is carried out.

Second, high inflation and abrupt changes in price structure complicate planning (especially the long-term development of firms and households). As a result, the uncertainty and risk of doing business increases. The price for this is an increase in interest rates and profits. Investments are beginning to be of a short-term nature, the share of capital construction in the total volume of investments is decreasing and the share of speculative operations is increasing. In the future, this may lead to a decrease in the welfare of the nation and employment.

Thirdly, the political stability of society decreases, social tension increases. High inflation contributes to the transition to a new structure of society.

Fourth, relatively higher rates of price growth in the “open” sector of the economy lead to a decrease in the competitiveness of national goods. The result will be an increase in imports and a decrease in exports, an increase in unemployment and the ruin of commodity producers.

Fifth, the demand for a more stable foreign currency is increasing. The outflow of capital abroad, speculation in the foreign exchange market are increasing, which in turn accelerates the growth of prices.

Sixth, the real value of savings accumulated in monetary form is decreasing, and the demand for real assets is increasing. As a result, the prices of these goods are rising faster than the overall price level is changing. The acceleration of inflation spurs the growth of demand in the economy, leads to a flight from money. Firms and households have to incur additional costs to buy real assets.

Seventh, the structure is changing and the real revenues of the state budget are decreasing. The state’s ability to pursue expansionary fiscal and monetary policies is narrowing. The budget deficit and public debt are increasing. The mechanism of their reproduction is launched.

Eighth, in an economy operating in part-time employment, moderate inflation, slightly reducing real incomes of the population, makes it work more and better. As a result, creeping inflation is both a “pay-off” for economic growth and an incentive for it. Deflation, on the contrary, leads to a decrease in employment and capacity utilization.

Ninth, there is a multidirectional movement of relative prices of the volumes of production of various goods.

Tenth, in conditions of stagflation, a high level of inflation is combined with high unemployment. Significant inflation does not provide an opportunity to increase employment. However, there is no direct relationship between inflation, on the one hand, and output, and unemployment, on the other.