The structure and content of the contract are largely individual in nature and are determined by the type of foreign trade operation, the subject of the transaction, as well as the degree of confidence in the partner. The parties to the transaction independently choose certain wordings of the articles of the contract, taking into account the situation on the market, trade customs, and the needs of the parties. In addition, some conditions are determined by international agreements, general conditions of trade.

The approximate structure of the contract of sale may consist of the following articles (sections, conditions):

Introductory part (preamble), definition of the parties. Subject of the contract. Quantity. Delivery time and date. Price and total amount of the contract. Basic terms of delivery. Quality of goods. Terms of payment. Packaging and labeling. Delivery-acceptance. Insurance. Claims (complaints). Sanctions. Force majeure. Dispute Resolution or Arbitration. Other terms of the contract. Legal addresses and signatures of the parties.

Contents of the articles of the treaty

Introductory part (preamble)

Precedes the text of the contract and usually has the following content: the name and number of the contract; place and date of conclusion of the contract; identification of the parties making the transaction.

When determining the parties, the trade names under which the counterparties are registered in the trade (state) register of their country, their legal status, location (name of the country or city), as well as the name of the parties in the text of the contract (for example, seller and buyer, supplier and customer) are usually indicated. It can also indicate the persons authorized to sign it, and the documents on the basis of which they are granted powers.

The place where the contract was signed may have legal significance in certain cases. For example, if the parties to the contract have not stipulated the terms of the law that will guide them in the consideration of disputes, then it is the place of conclusion of the contract (its signing) that will indicate the applicable law, since the conflict-of-laws rule of private international law establishes that the law governing a foreign trade transaction is determined at the place of conclusion of the contract.

Subject of the contract

(English – subject of contract; French – objet du contract; German– Gegenstand des Vertrages).

When determining the subject of the contract, the type of foreign trade transaction, the exact and full name of the goods (characteristics, assortment, etc.) are indicated in a brief form. When supplying equipment, the characteristics of the goods include, for example, the determination of its performance, power, fuel or energy consumption and other indicators. When determining the range of goods, types, styles, varieties, brands and models of the supplied goods are indicated. If the contract provides for the supply of goods of different names, quality characteristics and different assortments, they are usually indicated in the annex-specification signed by the parties attached to the contract and forming an integral part of it. In practice, this section of the contract often includes the basic terms of delivery and its quantity.

Quantity

When determining the quantity of goods in the contract of sale, the following are established: the unit of measurement of quantity, the procedure for establishing the quantity, the system of weights and measures.

The unit of quantity. The quantity of goods in the contract can be expressed by measures of weight, volume, length, area, in pieces. The choice of a unit of measurement depends on the nature of the product itself and on the established practice in international trade in a particular product. For example, weight measures are usually used to indicate the quantity of goods such as cereals, rubber, sugar, coal, ores, non-ferrous metals. In timber trade, measures of length and measures of volume (cubic meters) are used. In the trade of petroleum products, both weight measures and volume measures (barrel) are applied. In the cotton trade, the basic unit of quantity measurement is weight, but the size of the commodity supply is expressed by the number of bales of a certain average weight. In the trade in machinery and equipment, clothing, books, watches, the quantity is usually set in pieces, and the size of the deliveries is determined by the number of pieces included in a particular batch. In the trade of some other goods (mercury, matches, coffee), the unit of measurement is the quantity of goods in a certain package of a bottle, box, bag, pack. The quantity of some specific goods is determined in contracts in terms of conventional units. For example, the quantity of a number of chemical goods is determined in terms of 100% of the content of the main substance.

The procedure for determining the quantity. The quantity of goods to be delivered can be determined either by a firmly fixed figure or within established limits. Sometimes a fixed quantity is accompanied by a clause granting the seller or buyer the right to purchase an additional quantity of goods on the same (or different) terms within the same (or different) period, indicating the period during which one party must notify the other party of its intention to exercise its right. This right is expressed by the words “optional” or “optional”.

In sales contracts for bulk raw materials and foodstuffs supplied in bulk, in bulk or in bulk, the quantity designation is usually supplemented by a clause allowing the deviation of the quantity of goods actually supplied by the seller from the quantity stipulated in the contract. This clause is called the “about” clause and can be expressed in one of the following ways: the word “about” is placed before the figure determining the quantity of goods (English – about; French – environ; German – etwa, zirka, cirka); after the figure that determines the quantity, the words “more or less on … %” are put (English – more or less; French – en plus on en moins; German – mehr oder weniger); after the figure indicating the quantity of goods, a sign ± … % is placed.

The “about” clause usually applies to the carriage of goods by sea. In this case, the parties take into account that it may be difficult to charter the vessel of the required tonnage and deliver exactly the quantity stipulated in the contract. The “about” clause allows the seller to make the most of the cargo capacity of the vessel and not to pay for the so-called “dead freight”, i.e. freight for the unused space of the vessel.

Usually, the contract sets at what price the payment for the super-contract quantity will be made. This calculation can be made both at the contract price and at the price existing on the market at the time of execution of the transaction. In the latter case, when delivering on CIF terms, depending on the state of market conditions, the seller often uses this clause to his advantage.

The establishment of a system of weights and measures in the contract of sale is necessary because some countries use different systems of weights and measures from the generally accepted ones. Thus, the countries of Western Europe, Central and Latin America, most countries in Africa and Southeast Asia adhere to the metric system, but also apply their own, national systems of measures. The U.S. uses the American system, as well as, with some variations, the metric system of measures.

Where firms from countries with different systems of measures are parties to a contract, the number is reported in both systems to avoid misunderstandings.

The same units of measurement (for example, bushel, bale, bag, barrel) in different countries contain completely different quantities. Therefore, when indicating a quantity in units that have different values in different countries, the equivalent of this quantity in the metric system of measures is usually indicated.

The contract of sale also stipulates whether the packaging and packaging are included in the quantity of goods supplied. Depending on this, the following are distinguished: gross weight ( gross weight) – the weight of the goods together with the inner and outer packaging, including packaging materials; legal net weight – the weight of the goods without any packaging; gross weight per net – the weight of the goods with containers, when the cost of the container is equated to the cost of the goods (in cases where the weight of the container is not more than 1-2% of the weight of the goods and when the price of the container differs little from the price of the same weight unit of goods – bags, plastic bags). In this case, the weight of the container is neglected and the gross is taken as net.

Delivery time and date

Delivery time is the time periods agreed upon by the parties and provided for in the contract during which the seller must transfer the goods to the buyer or on his behalf to a person acting on his behalf. The quantity of goods specified in the contract can be delivered at a time or in parts. With a one-time delivery, one delivery time is established. When delivering in parts, the contract specifies the delivery time of each batch of goods.

The delivery time in a sales contract can be set in one of the following main ways:

determining the calendar day of delivery (fixed date); determining the period during which the delivery must be made (calendar month, quarter or year). In this case, the words “during” or “no later” are added. With periodic deliveries, the term may be indicated by the words “monthly”, “quarterly”. Long-term contracts usually set the total duration of the contract and intermediate terms, which can be determined either for the entire duration of the agreement or at the end of each calendar year for the following year. Setting the delivery date by determining the period is most common in commercial transactions of foreign firms; the use of trade-accepted special terms, such as “immediate delivery” (English – immediate, prompt; French – immediat; German – prompt); “quick delivery” (English – quick); “without delay” (French – livraison); “goods in stock on the spot” (English – spot; French – marchandise vendue en disponible); All these terms are usually used in a contract in cases where a short period of time elapses between the conclusion of the contract and its execution, calculated in days, i.e., when at the time of the conclusion of the contract the goods are already at the disposal of the seller at the place of delivery.

The term “immediate delivery” is most often used in international trade. Immediate delivery means delivery within a certain number of days after the conclusion of the contract. This number of days is determined by the customs of trade and the practice of trading in individual goods and is usually between 1 and 14 days. The definition of the delivery time using terms is used when concluding contracts on commodity exchanges, international auctions, when selling goods from stock.

Sometimes contractors do not set the exact delivery date at all, but determine it by the agreed conditions: “for harvesting”, “during the summer”, “after the opening of navigation”. At the same time, unless otherwise specified in the contract, the period during which the goods must be delivered after the occurrence of this condition is determined by the trade customs and customs of this branch of trade.

If the contract does not set a delivery date for the goods, the term of performance of delivery obligations is determined on the basis of laws and trade customs, the customs of the country whose law is applicable to this contract.

The contract may provide for the seller’s right to deliver the goods ahead of schedule. If this right is not stipulated in the contract, early delivery is possible only with the consent of the buyer, because usually it involves early payment for the goods by the buyer.

The date of delivery is the date of delivery of the goods to the buyer. Depending on the method of delivery, the date of delivery may be:

the date of the document issued by the transport operator that accepted the goods for carriage (e.g. the date of the bill of lading or navigator’s receipt, the date of the border station stamp on the consignment note; the date of the air waybill, etc.); date of customs clearance of the goods; the date of signing of the acceptance act by the commission of representatives of the seller and the buyer, etc.

According to the legislation of the Republic of Belarus (Decree of the President of the Republic of Belarus of 4.01.2000 No. 7, Article 29), the date of shipment (receipt) of goods under a foreign trade contract is considered to be the day of their customs clearance in the customs regimes provided for by the Customs Code of the Republic of Belarus (with the exception of transit). If, in accordance with the legislation, customs clearance is not carried out, the date of shipment of goods is the date of their release from the warehouse, and the date of receipt is the date of their posting in accordance with the established procedure by the importer.

Price and total amount of the contract

The contract usually sets the unit price and specifies the total amount of the contract. When setting the price of goods, the following are determined:

– unit of measurement – depends on the nature of the product and the practice that has developed in the trade of this product on the world market. The price in the contract can be set: for a certain quantitative unit of goods, usually used in the trade of this product (unit of weight, length, area, volume, in pieces, sets, etc.) or in counting units (hundred, dozen); per weight unit, based on the basic content of the main substance in the product (for ores, concentrates, chemicals, etc.); per weight unit, depending on fluctuations in natural weight, the content of foreign impurities and humidity.

When supplying goods of different quality and assortment, the price is set per unit of goods of each type, grade, brand separately. When a large number of goods of different qualitative characteristics are delivered under one contract, their prices are usually indicated in the specification that forms an integral part of the contract. In the supply of complete equipment, prices are usually set by position for each partial delivery or for individual component parts and are indicated in the annex to the contract. If the price is based on a weight unit, it is necessary to determine the nature of the weight (gross, net, gross to net) or to specify whether the price includes the cost of containers and packaging. This indication is also necessary in cases where the price is set per piece or set;

price basis – is determined in relation to the place of delivery, establishes what costs for the delivery of goods are included in the price of the goods (transport, insurance, warehouse, etc.). The basis of the price is usually determined by the use of special terms – FCA, FOB, CIF, etc .; price currency – the number of monetary units of a certain currency system for the goods supplied. This can be the currency of the country of the exporter, importer or third country. When choosing a currency, the prices of mass goods are of great importance to the trading customs that exist in the trade of these goods. For example, in contracts for rubber, non-ferrous metals, it is customary to set prices in pounds sterling, for petroleum products, furs – in US dollars.

The exporter seeks to fix the price in a relatively more stable currency, and the importer, on the contrary, is interested in setting the price in a currency subject to impairment;

– method of fixing the price – the price can be fixed in the contract at the time of its conclusion, during the term of validity or by the time of its execution. Depending on the method of fixation, the following types of prices are distinguished: solid (fixed), mobile (floating), sliding, with subsequent fixation:

The fixed price (English – firm, fixed) is set at the time of signing the contract and is not subject to change during the entire term of validity. It is used both in transactions with immediate delivery, delivery within a short period, as well as in transactions with long delivery times. In the latter, the clause “the price is fixed, not subject to change” is usually made. Mobile (floating) price (English – flexible) – the price fixed at the conclusion of the contract, in the future can be revised if the market price of this product changes by the time of its delivery. When fixing a rolling price, a clause is made in the contract stipulating that if by the time the transaction is executed, the market price rises or falls, the price fixed at the time of the conclusion of the contract will be changed accordingly. This clause is called a fall and rise clause (French: Baisse et hausse clause; German: Baisse und Hausseklausel). Usually, the contract stipulates the permissible minimum deviations of the market price from the contract price (2 – 5%), within which the revision of the fixed price is not made. When setting a mobile price, the contract must specify the source by which the parties will judge the change in the market price. Moving prices are most often set for industrial, raw materials and food products supplied under long-term contracts; Sliding price is a price set at the time of contract execution by revising the contract (base) price, taking into account changes in production costs that occurred during the execution of the contract. If the contract provides for partial deliveries, the rolling price is calculated separately for each delivery. Sliding prices are used in contracts for goods that require a long production period. Most often these are large industrial equipment, ships, etc.

When signing a contract in this case, the so-called base price is fixed and its components are stipulated, i.e. the share in percentage of fixed expenses (profit, overhead, depreciation deductions, etc.), raw materials and materials costs, wages, and the formula for calculating the sliding price is given.

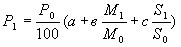

The most commonly used method is the sliding price calculation proposed by the United Nations Economic Commission for Europe in the General Conditions of Export of Machinery. This method uses the following formula to calculate the rolling price:

![]()

Where is

Where is ![]()

![]() – the final price under the contract;

– the final price under the contract;

![]() – the contractual (basic) price established on the day of conclusion of the contract (usually this price is the price provided for in the contract minus the cost of packaging, transportation and insurance);

– the contractual (basic) price established on the day of conclusion of the contract (usually this price is the price provided for in the contract minus the cost of packaging, transportation and insurance);

![]() – the average arithmetic or weighted average price (or the average of price indices) for the raw materials and materials listed in the contract for the period of execution of the contract or its part;

– the average arithmetic or weighted average price (or the average of price indices) for the raw materials and materials listed in the contract for the period of execution of the contract or its part;

![]() – the price (or price indices) of the mentioned materials at the time of signing the contract;

– the price (or price indices) of the mentioned materials at the time of signing the contract;

![]() – the average arithmetic or weighted average salary, including social security expenses and contributions, or the corresponding indices in respect of the contracted category of labour for a specified period;

– the average arithmetic or weighted average salary, including social security expenses and contributions, or the corresponding indices in respect of the contracted category of labour for a specified period;

![]() – wages or relevant indices in respect of the same categories of labour at the time of signing the contract;

– wages or relevant indices in respect of the same categories of labour at the time of signing the contract;

a, c, c – express the percentage of individual elements of the contract price established in the contract (their amount is 100%);

a – fixed part of the costs;

c – share of material costs;

c – the share of salary expenses, including expenses and social security contributions.

The contract necessarily specifies the sources on the basis of which the change in the cost of materials and wage rates for the accounting period is determined.

In the practice of international trade, other methods of calculating the moving price are also used. In each case, the parties must fix in the contract the method they are using or indicate what changes they are making to the formula proposed by the UNECE.

When a rolling price is set in an increasing market environment, some restrictive conditions may be introduced into the contract in the interests of the importer. In particular, a limit may be established as a percentage of the contract price, within which the price is not revised, as well as a percentage limit on the possible change in the contract price (for example, not exceeding 10% of the total amount of the order), which is called the slip limit. In addition, the contract may provide that the slip does not apply to the entire amount of production costs, but only to certain elements thereof (for example, metal during the construction of the vessel), indicating their value as a percentage of the total value of the order. Finally, the contract may not provide for a price slide for the entire duration of the contract, but for a shorter period (e.g. for the first 6-8 months from the date of conclusion of the contract), since during this period the supplier can purchase all the necessary materials for the execution of the order.

In practice, a mixed method of fixing the price is sometimes used, when part of the price is fixed firmly at the conclusion of the contract, and the other part – in the form of a sliding price.

The price fixed during the execution of the contract. In this case, the contract stipulates the conditions for fixing and the principle of determining the price level. For example, the price may be fixed by agreement of the parties prior to the delivery of each contracted shipment of goods or for long-term deliveries before the beginning of each calendar year. The buyer may be given the right to choose the moment of fixing the price during the period of execution of the transaction with the reservation of which sources of information about prices he should use to determine the price level. Thus, in transactions on commodities, it is negotiated according to the quotes of which exchange and according to which heading of the quotation bulletin the price will be determined, as well as the period during which the buyer is obliged to notify the seller of his desire to fix the price in the contract. Such transactions are called on-call transactions.

– price level – when determining the price level, counterparties usually focus on two types of prices: published and calculated.

Published prices are the prices of special and branded sources of information. They usually reflect the level of world prices. The world price is understood as the price at which large commercial export and import operations are carried out with payments in freely convertible currency. Practically world prices in these conditions are the export prices of the main suppliers of this product and import prices in the most important import centers of this product. For example, for wheat and aluminum, Canada’s export prices are world prices; lumber – Sweden’s export prices; rubber – prices of the Singapore Stock Exchange; for furs – the prices of London auctions, for tea – the prices of auctions of Kolkata, Colombo and London. While the world price for commodities is determined by the main supplying countries, the leading firms that produce and export certain types of products play a decisive role in finished products and equipment.

Published prices include: reference prices, stock quotes, auction prices, prices given in general statistical directories, prices of actual transactions, bid prices of large firms.

Reference prices are the prices of goods in the domestic wholesale or foreign trade of foreign countries, published in various printed publications. Sources of reference prices are economic newspapers and magazines, special bulletins, company catalogs and price lists. Reference prices can be either purely nominal, not related to real commercial transactions (requests or untraded offers of sellers), or reflecting past transactions made during the past week, month. Reference prices for a number of goods play the role of only a starting point from which the bargaining of prices begins when concluding transactions. Sometimes reference prices are used to determine the price level with the subsequent fixation, moving or moving price. Reference prices in most cases are the so-called basic prices, i.e. prices of goods of a certain quality and quantity, specification, chemical composition, etc. in a predetermined geographical point (basis point).

Stock quotes are the prices of commodities that are the object of exchange trading and mainly reflect actual transactions. In cases where stock quotes do not have specific transactions behind them, when they are published, the letter “H” is placed before the price, marking the nominality of the quote.

Auction prices are close to the quotes of exchanges, as they reflect, as a rule, real transactions.

Average export and import prices, calculated on the basis of foreign trade statistics by dividing the value of goods by their quantity, are more indicative than reference prices, although they reflect not so much the prices of export-import transactions actually made during this period, as exports or imports carried out in the relevant period of time. This shift in time is particularly important in industries where there is a large gap between the selling season and actual exports, such as the lumber trade.

The prices of the actual transactions are most applicable to determine the price level in the contract. However, these prices, as a rule, are not regularly published, and appear in the press sporadically only for individual transactions. Nevertheless, comparing the prices of actual transactions with reference ones makes it possible to more correctly establish the price level in the contract.

The bid prices of large firms are less representative than the prices of actual transactions because the bid prices are essentially reference in nature, since the initial prices for the conclusion of transactions as a result of bargaining usually decrease.

Published prices are mainly of a reference nature and quite often significantly deviate from those actually paid by the buyer due to the widespread use of the system of discounts from the price. The amount of discounts depends on the nature of the transaction, the terms of delivery and payment, the relationship with the buyer and the market situation at the time of the transaction. Currently, about 20 different types of discounts are used in the practice of international trade. The most common types of discounts are:

A general (simple) discount is provided with a price list or from the reference price of the goods. A simple discount from the list price is usually 20 – 30%, and in some cases reaches 30 – 40%. Such discounts are widely used when concluding transactions for machines and standard types of equipment. Discounts from the reference price are usually used in the supply of industrial raw materials and average from 2 to 5%. A simple discount includes a discount provided when buying goods for cash (skonto). It is given by the seller in cases where the reference price provides for a short-term loan, and the buyer agrees to pay in cash. This discount is usually 2 – 3% of the reference price or corresponds to the amount of interest that exists in the money market. A discount for turnover (bonus) is provided to regular customers on the basis of a special agreement. In this case, the contract establishes a scale of discounts depending on the turnover achieved during a certain period (usually one year), as well as the procedure for paying amounts based on these discounts. For some types of equipment, bonus discounts reach from 15 to 30% of turnover, for raw materials and agricultural products – several percent. A discount for quantity or seriality (progressive) is provided to the buyer subject to the purchase of a predetermined increasing amount of goods. Serial orders are of great interest to manufacturers, as production costs are reduced in the manufacture of machines of the same type and size. Dealer discounts are provided by manufacturers to their permanent representatives (sales intermediaries). These discounts are widespread when selling cars, tractors and some types of standard equipment. Dealer discounts on cars average 15 – 20% of the retail price, depending on the brand of the car. Special discounts are provided to privileged buyers, in whose orders sellers are especially interested. The category of special discounts also includes discounts on trial batches and orders in order to interest the buyer, as well as discounts for long-term cooperation, with the help of which manufacturers seek to retain regular customers. Export discounts are provided when selling goods to foreign buyers. They tend to be higher in size than discounts for buyers in the domestic market. This type of discount is provided to increase the competitiveness of a particular product in the foreign market. Seasonal discounts are provided for the purchase of goods outside the season. For example, for agricultural fertilizers, they are about 15%. Hidden discounts can be provided to the buyer in the form of discounts on freight, preferential or interest-free loans, the provision of free services, the provision of free samples in large quantities, etc. Discounts for the return of previously purchased goods (English – trade in) in the amount of 20 to 30% of the list price are provided to the buyer when returning to him an outdated model of goods that were purchased from this company. Such discounts are often applied when selling cars, electrical equipment, rolling stock, standard industrial equipment, etc. Discounts when selling used equipment are sometimes up to 50% of the original price of the goods.

Estimated prices of the supplier are used in contracts for non-standard special equipment, which is produced according to individual orders. It is impossible to compare it with other similar equipment due to large differences in design, performance, quality, etc. In this regard, the prices for special equipment are calculated and justified by the supplier for each specific order, taking into account the technical and commercial conditions of this order, and in some cases are finally established only after the execution of the order. The level of the estimated price is influenced by the fact that special machines and equipment are most often produced by monopolistic firms, using the latest patented technologies, highly qualified personnel. Information about the prices of such equipment is rare in print, so it cannot be used for comparison when choosing a price level.

The prices of previous transactions are used in the case of relative price stability in the market, primarily for industrial raw materials, machinery and standard equipment. They are most often used when placing orders in the case of stable relations between counterparties.