Since the balance of payments is a statistical summary of a country’s transactions with the outside world, each transaction must belong to a particular section in accordance with certain classification principles. The definition of standard balance-of-payments components is based on the following main considerations: the allocated balance of payments component should differ in behavioural patterns and differ significantly from other components; it should be of significant importance to a number of countries; there should be enough statistics for each component to quantify it; each component should be used in the SNA, monetary and public sector statistics; finally, the list of standard components should not be too long and disaggregated so as not to complicate subsequent analysis.

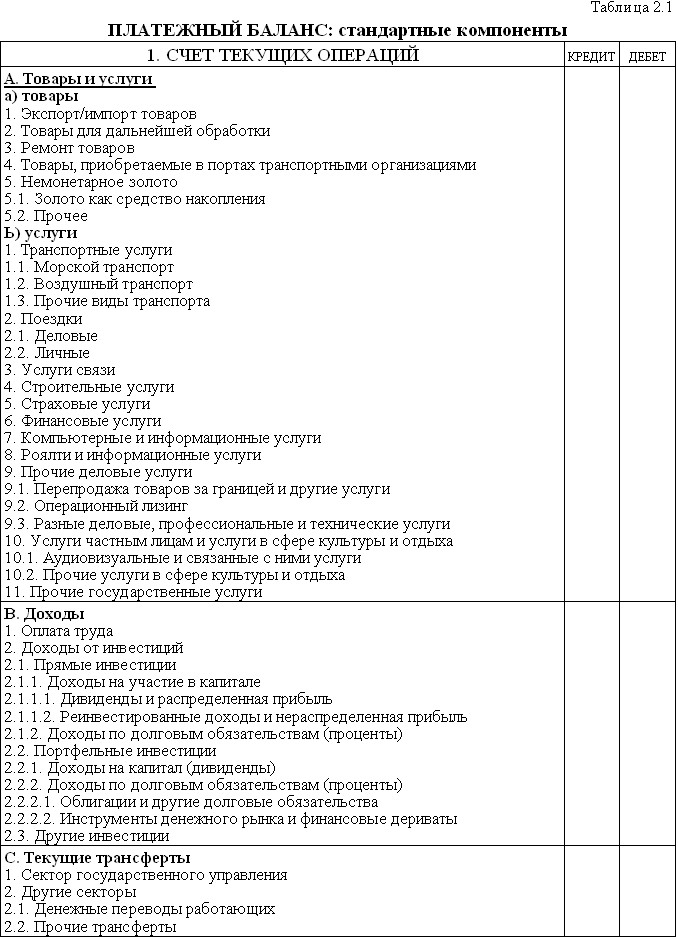

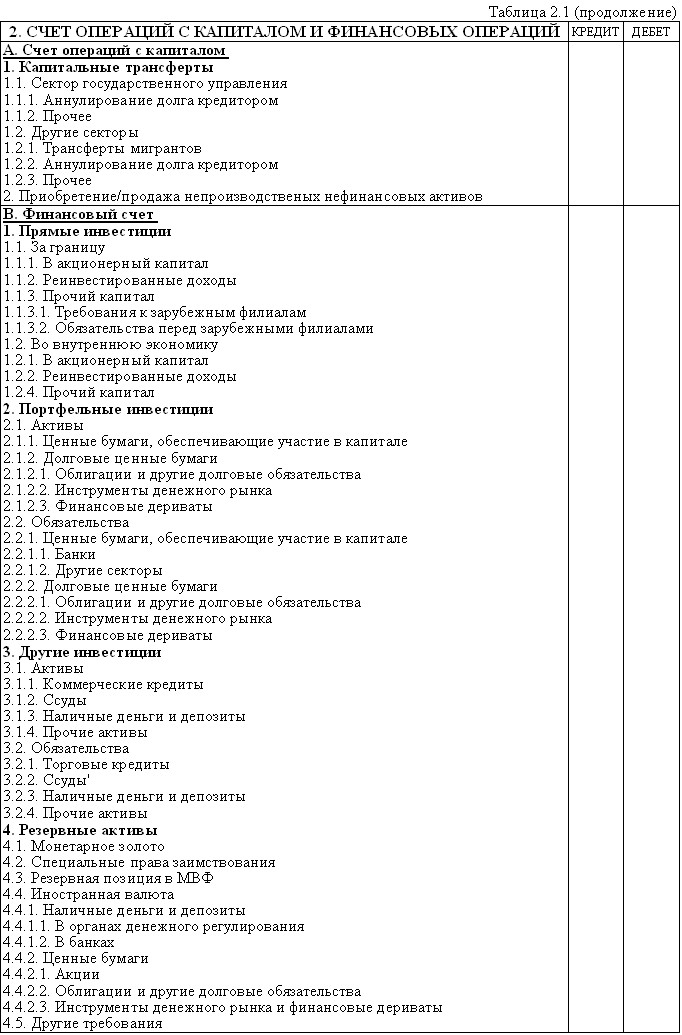

The standard balance of payments consists of two sections:

the current account, which shows the international movement of real wealth (primarily goods and services); an account of operations with capital and financial transactions, showing the sources of financing the movement of real material values (see further Table 2.1).

In accordance with the recommendations of the IMF, the compilation of the balance of payments is carried out according to the method of economic transactions, when the criterion for accounting for the transaction is the transfer of ownership from residents to non-residents and, conversely, as a result, accounting for various stages of foreign trade operations is ensured, all claims and liabilities of the country to foreign countries, including outstanding ones, are reflected.

The double-entry system for credit and debit items assumes the existence of the resulting zero balance of payments. However, in practice, due to the complexity of the full coverage of transactions, the heterogeneity of prices, the difference in the time of registration of transactions and other reasons, discrepancies are inevitable, the amount of which balances the total result of the balance of payments and is reflected in the article “Errors and omissions”.

Net errors and omissions – an item of the balance of payments that reflects omissions of payments that for some reason were not recorded in other items of the balance of payments, and errors that are closed in the record of individual payments.

Net errors and omissions can occur in the following cases: If only the debit or only the credit for a particular transaction was recorded in the balance of payments or for some reason the recorded credit is not equal to the debit. For example, trade credits are recorded in short-term capital, however, in most cases, it is not possible to track exactly the imports that were bought with these loans, i.e. their use. If the debit and credit for the same record were obtained from different sources that do not coincide in the compilation methodology and / or reflect different time intervals. For example, the receipt of trade credits is recorded according to the data of creditors, and their use for the import of goods – according to national customs statistics. If either the debit or the credit record of the balance of payments is incorrectly estimated.

As a rule, in developed countries, the amount of errors and omissions is relatively small and stable. However, it can increase sharply and reach impressive values in countries with weak control over foreign trade operations. In this case, changes in its value can be judged by the presence of an unregistered outflow (or inflow) of capital.

Brief conclusions. So, the balance of payments is a statistical report, which in a systematized form provides summary data on foreign economic operations of a given country with other countries of the world for a certain period of time. The construction of the balance of payments is based on the double-entry system, determines the economic territory of the country, distinguishes between residents and non-residents, is based on market prices that existed at the time of the transaction, and uses the unit of account used in the national economy, with its subsequent conversion into US dollars at the current market rate. The balance of payments integrates the accounts of many sectors and is based on customs statistics, monetary sector statistics to the extent that they take into account international transactions, external debt statistics, statistical surveys carried out primarily in the services sector and statistics on foreign exchange transactions. The standard balance of payments consists of two sections: the current account, which shows the international movement of real material values (primarily goods and services), and the capital and financial transactions account, which shows the sources of financing the movement of real material values.