Fiscal (fiscal) policy – measures of the government to change public spending, taxation and the state of the state budget, aimed at ensuring full employment, balance of payments equilibrium, economic growth in the production of non-inflationary GDP (GNP).

The main instruments for the implementation of fiscal policy are tax and budget regulators. Tax regulators include the established types of taxes and payments, their structure, objects of taxation, subjects of payments, sources of taxes, rates, benefits, sanctions, terms of collection, methods of payment, etc. As budget regulators, the level of centralization of funds by the state, the ratio between the federal or republican and local budgets, the budget deficit, the ratio between the state budget and extrabudgetary funds, the budget classification of income items and expenses, etc.

Fiscal policy, depending on the mechanism of response to changes in the economic situation, is divided into discretionary and non-discretionary (automatic), in accordance with which the mechanism of its functioning is determined, the forms and methods of regulation are specified.

Discretionary fiscal policy is a purposeful change in the values of public expenditures, taxes and the state budget as a result of special government decisions aimed at changing the level of employment, output, inflation rates and the state of the balance of payments.

Non-discretionary (automatic) fiscal policy is an automatic change in these values as a result of cyclical fluctuations in total income. Non-discretionary fiscal policy involves an automatic increase (decrease) in net tax revenues to the state budget during periods of growth (decrease) of GNP, which has a stabilizing effect on the economy.

Net tax revenues are the difference between the amount of total tax revenues to the budget and the amount of transfers paid by the government.

With discretionary fiscal policy, in order to stimulate aggregate demand during a recession, a state budget deficit is purposefully created due to an increase in government spending (for example, to finance programs to create new jobs) or tax cuts. Accordingly, during the period of recovery, a budget surplus is purposefully created.

The discretionary policy of the government is associated with significant internal time lags, since a change in the structure of public spending or tax rates implies a lengthy discussion of these measures in parliament.

With a non-discretionary fiscal policy, the budget deficit and surplus arise automatically as a result of the built-in stabilizers of the economy.

“Built-in” (automatic) stabilizer is an economic mechanism that operates in self-regulation mode and allows to reduce the amplitude of cyclical fluctuations in employment and output levels, without resorting to frequent changes in the government’s economic policy. Such stabilizers in industrialized countries are usually a progressive taxation system, a system of state transfers, including unemployment insurance and a system of profit sharing. The built-in stabilizers of the economy relatively mitigate the problem of prolonged time lags of discretionary fiscal policy, since these mechanisms are “turned on” without the direct intervention of the parliament.

The degree of built-in stability of the economy directly depends on the values of cyclical budget deficits and surpluses, which act as automatic “shock absorbers” of fluctuations in aggregate demand.

Cyclical deficit (surplus) is a deficit (surplus) of the state budget caused by an automatic reduction (increase) in tax revenues and an increase (reduction) in government transfers against the background of a recession (rise) in business activity. The effect of “built-in stabilizers” is explained as follows. In the cyclical upswing phase, tax deductions automatically increase, and transfer payments automatically decrease. As a result, the budget surplus is increasing and the inflationary boom is being contained. During a cyclical downturn, taxes automatically fall and transfers rise. As a result, the budget deficit is increasing against the background of a relative increase in aggregate demand and output, which limits the depth of the recession.

The degree of stabilization impact of the budget deficit depends on the methods of its financing, which can be used: an increase in tax revenues to the state budget, the issuance of loans, money emission.

If the state budget deficit is financed by issuing state loans, this leads to an increase in the market rate of bank interest. And the growth of the latter leads to an increase in the cost of loans and to a decrease in the volume of investment, which reduces the stimulating effect of fiscal policy.

In the case of financing the state budget deficit through money emission, the state receives a special income (income from printing money), which is called seigniorage. Seigniorage occurs when the increase in the money supply exceeds the increase in real GNP, which leads to an increase in the average price level. As a result, all economic agents pay a kind of tax, and part of their income is redistributed in favor of the state through the mechanism of price increases.

However, it should be noted that the built-in stabilizers do not eliminate the causes of cyclical fluctuations of equilibrium GNP around its potential level, but only limit the scope of these fluctuations. On the basis of data on cyclical budget deficits and surpluses, it is impossible to assess the effectiveness of fiscal policy measures, since the presence of a cyclically unbalanced budget does not bring the economy closer to the state of full employment of resources, but can occur at any level of output. Therefore, the built-in stabilizers of the economy, as a rule, are combined with measures of discretionary fiscal policy of the government aimed at ensuring full employment of resources.

Discretionary fiscal policy, depending on the phase of the economic cycle, can be stimulating or constraining.

Stimulative fiscal policy (fiscal expansion) in the short term is aimed at overcoming the cyclical recession of the economy and involves increasing government spending, reducing taxes or combining these measures. In the longer term, tax cuts could lead to an increase in the supply of factors of production and an increase in economic potential. The implementation of these goals is associated with a comprehensive tax reform, accompanied by a restrictive monetary policy of the Central (National) Bank and optimization of the structure of public spending.

Restrictive fiscal policy (fiscal restriction) is aimed at limiting the cyclical recovery of the economy and involves reducing government spending, increasing taxes or combining these measures. In the short term, these measures can reduce demand inflation at the cost of rising unemployment and falling production. In a longer period, a growing tax wedge can serve as a basis for a decline in aggregate supply and the deployment of a mechanism for stagflation, especially when the reduction in public spending is carried out proportionally across all budget lines and no priorities are created in favor of public investment in labor market infrastructure. Protracted stagflation against the background of inefficient management of public spending creates the prerequisites for the destruction of economic potential.

The stabilization effect of taxes and government expenditures on economic development is due to the fact that they have a multiplier effect and have a direct impact on aggregate demand, the volume of national production, and employment. Thus, during a recession, the government, stimulating public spending, causes a multiplier increase in consumer spending and a multiplying effect of investment.

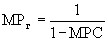

The public expenditure multiplier (MWG) is calculated by the formula:

,

,

where MRS is the marginal propensity to consume.

It shows the increase in GDP as a result of rising government spending on the purchase of goods and services.

With a significant level of unemployment, the state pursues a stimulating policy in the form of tax cuts. Lower taxes increase household incomes, leading to higher spending and higher aggregate demand, prices, output and aggregate supply. As a result, real GDP is rising. Low taxes also stimulate the growth of household savings and increase the profitability of entrepreneurial investment. This contributes to raising the rate of capital accumulation, expanding production, reducing unemployment and increasing the national product. Consequently, taxes also lead to a multiplier effect.

The net tax multiplier is the ratio of the magnitude of the change in aggregate demand to the magnitude of the given change in real net taxes. Its absolute value is determined by the formula:

MR taxes = MHr – 1.

If you substitute the value of the expense multiplier into this formula, you get:

MR taxes = MRS (1 – MRS).

Taxes, in comparison with government spending, have a lesser impact on the change in the national product. The tax multiplier is smaller than the government spending multiplier by the value of the marginal propensity to consume. This is because government spending is a component of total spending, and taxes are a factor affecting only consumption – one of the variables of total spending. In addition, if each monetary unit used for the purchase of goods and services has a direct impact on GDP growth, then with tax cuts, only one part of household income goes to the growth of consumption, since the other part goes to savings.

The government’s choice of forms and methods of stabilization fiscal policy also depends on the conceptual model of state regulation used. In the theory and practice of states with a market economy, two conceptual models are distinguished – neo-Keynesian and neoclassical.

The neo-Keynesian model of state regulation of the economy is based on the theory of J. S. Miller. Keynes. He attached particular importance to non-discretionary fiscal policy, which, in his opinion, could amortize the crisis. Built-in stability arises from the existence of a functional relationship between taxes and national income. Thus, the amount of net tax collected varies in proportion to the value of the net national product (NPV). Consequently, as the level of NPV changes, automatic fluctuations (increases or decreases) in tax revenues and emerging budget deficits and surpluses are possible.

The anti-inflationary effect is that as the PPP grows, producers’ incomes grow and there is an automatic increase in tax revenues, which over time causes a reduction in consumption, restrains excessive inflationary price growth, and ultimately causes a decrease in PNP and employment. The consequence of this is a slowdown in the economic recovery and the formation of a tendency to eliminate the state budget deficit and the formation of a surplus.

The neoclassical model of tax regulation is based on the theory of “supply economics”, in which one of the conditions for ensuring the growth of savings and the expansion of investment activity is a low level of taxes. To do this, the budgetary concept of A. Laffer is used, where the main variable is the marginal tax rates. Thus, if marginal rates reach a sufficiently high level, then incentives for entrepreneurial initiative and expansion of production are eliminated, profits fall, the process of tax evasion increases, and consequently, total tax revenues also decrease. Cutting marginal tax rates has the opposite effect.

Thus, neo-Keynesians build a mechanism of tax regulation based on changes in the level of taxes as a means of implementing countercyclical policies, reducing them during periods of economic recession, increasing in years of recovery and recovery in order to restrain business activity, and neoclassicism – on the basis of large-scale and targeted reductions in the overall level of taxes to maintain high levels of savings and investment, as well as expanding overall tax revenues.